How to dispute credit card charges made on Instarem’s amaze

This article covers:

No amount of words can describe how frustrating it is when you see a credit card amount not made by you.

And it’s not just for unauthorized transactions, there could be other reasons you would like to dispute a charge for.

If you are using Instarem’s amaze card, don’t let that frustration ruin your amaze-ing experience. In this article, we’ll talk about the type of disputes and the easy steps you can take to get your money back.

What are the typical reasons for a dispute?

There could be a myriad of reasons why you feel that you have been unfairly charged. Here are some typical reasons why people might want to dispute their payments:

- Cancelling recurring membership / subscription

- Duplicated payment

- Error in the payment amount

- Unprocessed refunds

- Did not receive goods and services

- Received defective goods or goods not as described

- You have paid by other means

- Unauthorised transaction(s)

You might be interested In: 5 ways to safeguard your Instarem amaze card

Okay, so who should you reach out to first?

Rule of thumb: try to settle with the merchant first.

Keep all communication with merchant in written form – via email or text. And if you prefer phone calls, always have a call summary sent via text or email.

This is important as the documentation will come in handy when you raise it up further for a chargeback.

It didn’t work out with the merchant, what’s next?

Okay now that the merchant is out of the equation and since you have charged your payment to the amaze card, it’s Instarem you should reach out to.

It’s simple to flag your issue with Instarem via your Instarem app!

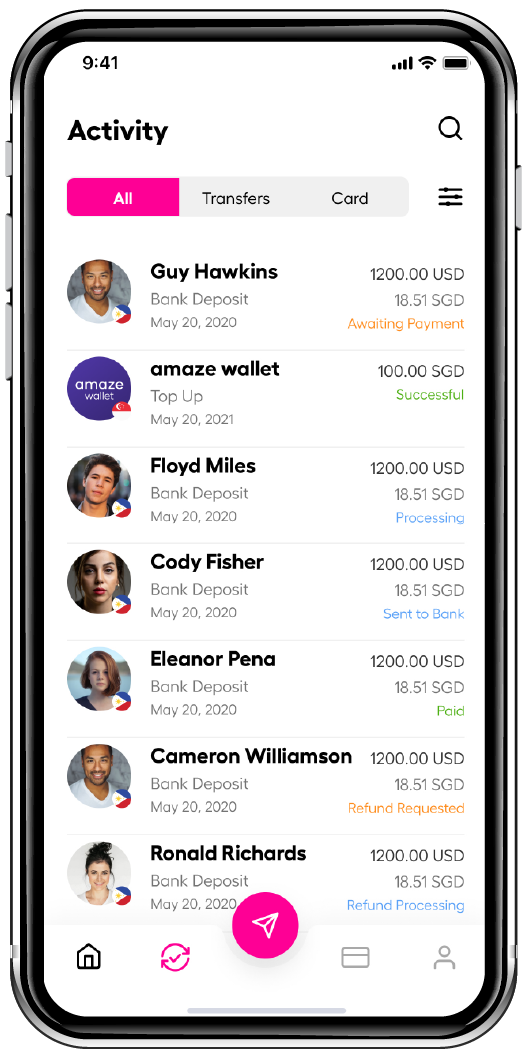

- Open your app

- Click on the activity button (second button on the bottom left)

- Click on the specific transaction and ‘Report a problem’ link at the bottom

Alternatively, You can go to Help Centre on the app and send an enquiry or fire up the ‘Ask Adam’ chatbot for instant assistance.

What documentation should you provide for the credit card dispute?

After you have contacted our customer experience team Help Centre or chatbot, you will be required asked to complete a dispute form and email it back within 14 days from the date of the unauthorised transaction.

Remember to also include your receipts and your communication with the merchants.

What happens after that?

Instarem will take it from here and will raise the issue on your behalf, to Mastercard for a chargeback. Do note, as per Mastercard’s rules, a dispute can only be raised once the transaction has been settled by the merchant. This means it may take up to 7 business days for the transaction to be posted and settled by the merchant.

Mastercard will act as the judge for the dispute. Both the merchant and Instarem will present their arguments through documentation.

Mastercard investigations may take up to 45 business days after the dispute is officially filed and accepted. Until then, sit back and let Instarem come back to you.

In the meantime, what should I do with my amaze card?

If it is an unauthorized transaction, it is recommended you request a replacement card and block your existing card, so it does not get misused again.

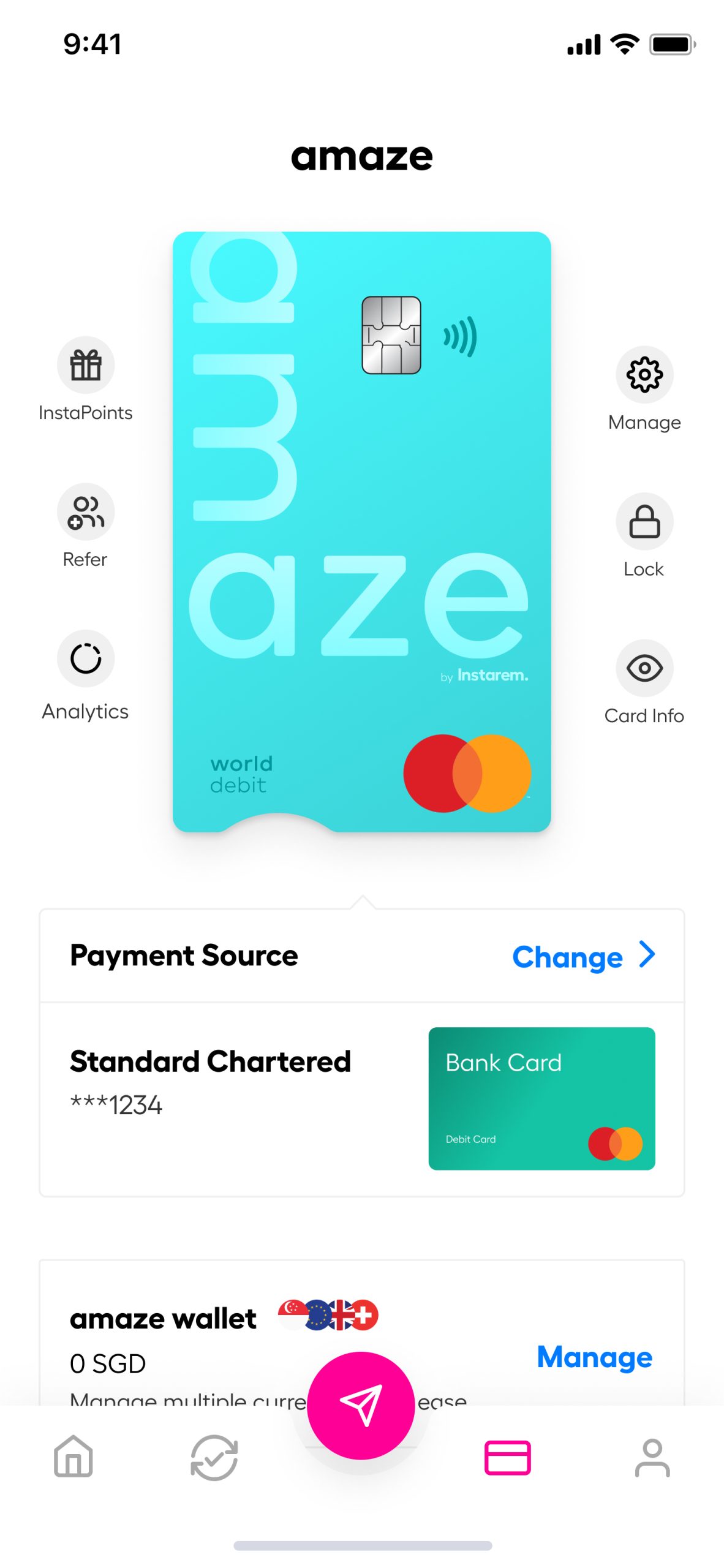

Go to the amaze screen on the Instarem app, click the ‘Manage’ icon at the top right. Click on ‘Replace a card’ and select the appropriate reason.

Your current card will then be blocked, and you will receive a replacement via direct mail within 14 days. Your new virtual card details will be visible on the app almost immediately so you can continue using amaze with no delay!

Get the app

Get the app