Getting A Health Insurance In Hong Kong? Here’s An Expat’s Guide

This article covers:

Moving to a new country for work or education needs a lot of planning. One of the most important things is to ensure that you are well covered financially. This includes a good healthcare plan which is often overlooked by most soon-to-be expats. Health insurance is critical during your stay abroad. Here’s an expat’s guide to choosing the right healthcare plan if you are planning to live in Hong Kong.

Public Sector

The Hong Kong Hospital Authority is responsible for setting up public hospitals and rehabilitation centres in the country that offer low-cost services to the residents. The seven divisions of the Hospital Authority manage 41 public hospitals and medical institutions, 48 specialist out-patient clinics, and 74 general out-patient clinics. These divisions ensure that quality healthcare is provided to patients within a certain area.

Fees

The fee for services in public hospitals varies according to the eligibility status of the individual. For example, accident and emergency patients have to pay $180 per visit, while non-eligible patients have to shell out $1,230 for the same. Similarly, for in-patient care, the charges for eligible patients range between $100 and $ 120 per day with $75 as admission fee. On the other hand, non-eligible patients pay somewhere around $2,340-$5,100 per day.

Eligibility Criteria

The eligibility criteria for getting treated in a public hospital at subsidized rates is as follows:

- Holders of Hong Kong Identity Card issued under the Registration of Persons Ordinance

- Children under 11 years of age with Hong Kong resident status

- Persons approved by the Chief Executive of the Hospital Authority

*People who do not meet the above criteria are classified as non-eligible for any kind of subsidy for treatment in a public hospital.

Private Sector

Hong Kong has 12 private hospitals. Though these hospitals have partnered with the United Kingdom for international healthcare accreditation, the Hong Kong Department of Health still regulates the private hospitals and medical clinics registered with the Medical Clinics Ordinance. The Department of Health also carries out thorough inspections to ensure that these hospitals and clinics follow all the regulations, and manages complaints from the public. The private sector supplements the services provided by the public sector by offering additional healthcare services to both residents and expats.

Fee

Those opting for private medical services have to shell out around $6,150-$6,650 for 1st class treatment and $4,080-$4,430 for 2nd class treatment. Therefore, it is essential for expats to get a private insurance cover to save yourself from paying hefty medical expenses.

Medical Fee Waiving Mechanism

The government of Hong Kong tries to offer help to patients who are unable to pay their medical bills. It has introduced the Comprehensive Social Security Assistance (CSSA), which allows recipients to receive a fee waiver for public healthcare services. Individuals who are not covered under CSSA, but belong to a low-income group can avail the fee waiver system. Similarly, elderly and seriously ill patients with limited means can also take advantage of the system. After approval, a checking mechanism is undertaken to ensure the integrity of each case, and patients are awarded the waiver either on a one-time basis or for certain a period of time, depending on the merits of their cases.

The schemes are usually meant for residents. However, under special circumstances, they may also be awarded to non-residents under the supervision of the Director of Social Welfare. In fact, expats who hold the Hong Kong Identity Card also qualify for the fee waiver, provided the requisite conditions are fulfilled. The amount of fee waived will vary from one case to another.

Health Insurance For Expats In Hong Kong

Hong Kong is one of the most expensive countries for private treatment, therefore, it is advisable to take either a standard policy or a comprehensive policy. As a soon-to-be expat in Hong Kong, healthcare expenses can really be a big concern. Hence, it is important that you thoroughly understand the health plan offered by your employer. If you are a student, some institutions provide group plans for you to enroll, but the plans usually provide only minimal and basic coverage and do not include medical and health insurance. You may check with the Student Affairs Office or International Office of the institution(s) you intend to apply to. However, the cover provided by these plans comes with certain limitations and terms & conditions. For instance, the plan might cover private medical practitioners for regular health problems, but might not cover critical medical issues like surgeries at private hospitals, making public hospitals a more cost-efficient alternative for expats in such cases. These limitations make it necessary for expats to take an additional cover.

Though international medical insurance is often more expensive, these plans provide better coverage. Premiums are calculated based on global medical inflation and for an individual. The premium is based on the age group and is not affected by the number of claims made. Unlike local health insurance, you can enjoy the benefits of your international health insurance plan even while you are travelling outside Hong Kong. The plan will cover all the geographies mentioned in the insurance policy. Some insurers even guarantee lifetime renewal, which means that you will be covered regardless of your health condition.

Some of the companies offering cover to expats include Pacific Prime, Alliance Insurance Services, Bupa (Asia) Limited, Zurich Insurance Hong Kong and others. A private international insurance provides comprehensive coverage to expatriates including that for dental care, which is generally not included in public healthcare plans.

The advantage of choosing an international plan is that it provides the individual with an opportunity to choose from a variety of doctors and hospitals, and also get treated without having to stand in long queues. Here are a few points you need to keep in mind before going for an international health insurance plan:

- Coverage For Emergency Repatriation: This includes costs for shifting the patient to an area where he can be treated with the best facilities.

- Coverage For Chronic Diseases: This allows cover for pre-existing ailments to some extent, depending on the merits of each case. However, an additional amount has to be paid for the same.

- Coverage For Maternity Care: Expenses relating to pregnancy and childbirth are exorbitantly high in Hong Kong. Hence, go for a plan that covers maternity care. Make sure that the cover is taken at least 12 months prior to the possibility of such a situation.

- Coverage For Specific Issues: Some policies may also be undertaken for protection against disability, dental and vision-related problems.

Consult An Insurance Broker

Looking for the right expat insurance plan by yourself could be very challenging as it is hard to choose from the plethora of products that cater to different needs of expats. Hence, it is advisable that you use the services of an independent insurance broker to make the right choice for yourself and your family.

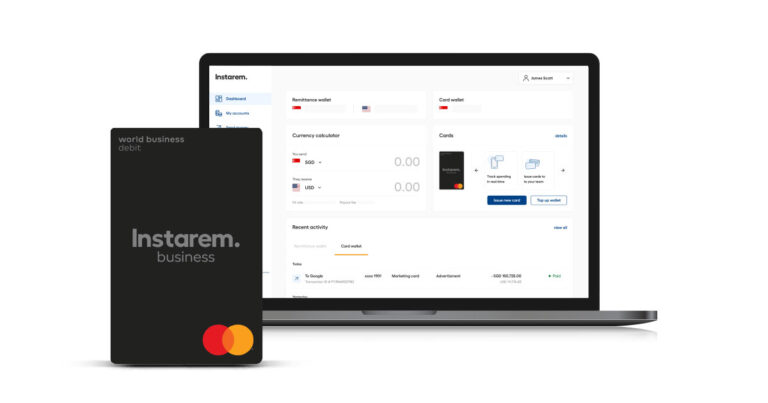

Hope we were able to address all your concerns. If you are planning to move to Hong Kong, choose a health plan right away and make hassle-free payments for premiums in Hong Kong via InstaReM – continuously updating mid-market rates straight from the provider, zero hidden fees and fast transfers – Sign Up now to live the experience.