This article covers:

Did you know that any profits you gain from the investment will be subject to investment tax?

In other words, you’re liable for taxation on any money earned from investments. This can come in the form of interest from any borrowed money used to buy shares or dividends paid by a company.

Read on to get a better understanding of:

- how your investments are taxed,

- when and how to declare them,

- and ways to make them more tax effective.

Investment tax explained

Investment taxation falls into two primary categories; income tax and capital gains.

The income investment tax will include any interest received from a savings account or shared dividends.

As for the investment tax for capital gains, it is a tax on the profit you’ve made from selling your investment. These are the two primary ways how your investment can be taxed.

When to declare your investment tax?

To avoid penalties, you must declare your earnings from investments and assets in tax returns. This is because the income investment you have may include and have amounts of interest, dividends, rental income, managed investments, trust credits, crypto assets and other capital gains.

If you failed to lodge any income investment tax declarations, ATO (Australia Taxation Office) can take action by applying a number of sanctions and penalties to you. However, if you are late in lodging, ATO will penalise you for late lodging.

Types of investment income

As mentioned, several types of investment income may apply to you. So it would be prudent to know the types of investment income, as it will help you to identify what kind of income investment tax declaration you should lodge.

Income from jointly held assets

Refers to the income you earned from assets that you shared with an individual; it can be property, land, etc. Thus, it will be assumed that the asset is divided and shared equally between you and the other individual.

Interest income

Australians must always declare their interest income as part of their taxable income.

This includes not only the interest received from banks but also penalty interest and earnings derived from children’s savings accounts belonging to you.

Further, any payments made with funds originating in those same children’s accounts are to be reported on your tax return too.

Dividends

Can be money or any other type of property or asset, such as shares. And should you receive a bonus share instead of money, the issuing company should provide a statement that shows the share is a dividend. Dividend income may come from channels such as;

- Listed investment companies

- Public trading trusts

- Corporate unit trusts

- Corporate limited partnerships (in the form of a distribution).

Rental property income

For income that you receive from rental property, you must make a full declaration for it in your tax return.

However, if you receive goods and services instead of rent, you need to work it out and declare the monetary value. The following is a list of payments that relate to your property rental income:

- Rental bond, the money you retain or keep – for example

- a tenant defaults on the rent

- damage to your rental property requiring repairs

- An insurance payout to compensate you for lost rent

- A letting or booking fee

- A reimbursement or recoupment for deductible expenditure, such as an amount from a tenant to cover the cost of repairing damage to your rental property. Include the whole amount you receive from the tenant in your income and you can claim a deduction for the cost of the repairs.

- The rent you receive through the sharing economy (renting out a room or a whole house or unit on a short-term basis, through a website or app)

Managed investment trusts

Managed investment trust (MIT) is a type of trust in which members of the public collectively invest in passive income activities such as shares, property or fixed-interest assets. A trust will be qualified as MIT if it meets certain requirements for the income year of its operation. And you must show any income or profits received from any trust investment in your tax return. Below is a list of income channels:

- Cash management trust

- Money market trust

- Mortgage trust

- Unit trust

- Managed funds – such as property trust, share trust, equity trust, growth trust, imputation trust or balanced trust.

Capital gains

The profits you made and realised by selling investments such as stocks, bonds, or real estate. This is applicable to any assets, including those purchased for personal use.

Capital gains can fall into two categories; short-term and long-term. Both categories must be claimed on your annual tax return. So, you must declare any amount of capital gains (or capital loss) you make when you dispose of capital assets, such as crypto assets, property assets or shares.

Crypto assets income

Crypto assets are digital representations of value you can transfer, store or trade electronically. As such, you must declare the rewards earned from staking crypto assets as other income in your tax return. The mentioned rewards usually come in the form of additional tokens from holding the original tokens. Thus, you will need to evaluate the value of the additional tokens at the time you receive them.

What if you have a co-ownership?

Only include your share of rental and expenses in your tax return, if the following conditions apply to you;

- You own a rental property jointly or in common with another person

- You have an interest in a partnership that carries on the rental property business.

What are negative & positive gearing?

In property investment, you will encounter these two terms; negative gearing and positive gearing. To put it simply the definitions for negative and positive gearing refer to the money that you have borrowed to invest. Whether they will be positive or negative will depend on your rental income and expenditure.

These will include interest and other expenses gone into your rental property investment.

Positive Gearing

If the income generated from your rental property is higher than your interest payments and other expenditures, such as property maintenance, then you will be positively geared.

Negative Gearing

However, if your investment income is lower than your interest payments and outgoings, then you will be negatively geared.

How to turn your investment into a tax-effective investment

There are ways for you to turn an investment made into a more tax-effective investment. What this means is that the tax on your income investment is lower than your marginal tax rate.

You might be interested in: How investments can be taxed in Australia

Superannuation

This is one of the ways to make your investment more tax-effective. It is a great way to save up for retirement too. So the reason why superannuation is one of the ways to make your investment tax-effective is that the government provides tax incentives. This includes;

- A tax rate of 15% on employer super contributions and salary sacrifice contributions if they’re below the $27,500 cap.

- A maximum tax rate of 15% on investment earnings in super and 10% for capital gains.

- No tax on withdrawals from super for most people over age 60.

- Tax-free investment earnings when you start a super pension.

Insurance bonds

The second way to make your investment tax-effective is by leveraging insurance bonds. This is because insurance bonds are investments offered by companies, so their tax rate is 30%. If there are no withdrawals made in the first 10 years, there will be no payable tax.

So if you are an investor with marginal tax rates higher than 30%, insurance bonds are great for you to make your investment more tax-effective.

To sum it up, it is imperative to know your investments are being taxed so that you can avoid unnecessary penalties by declaring and lodging them with ATO. Though you won’t be able to completely avoid the tax on your investments, you can make the investments more tax-effective. Thus allowing you to have lower marginal tax rates, which will help you to save up more.

But the most important thing is that you declare and lodge them according to the ATO’s rules and regulations.

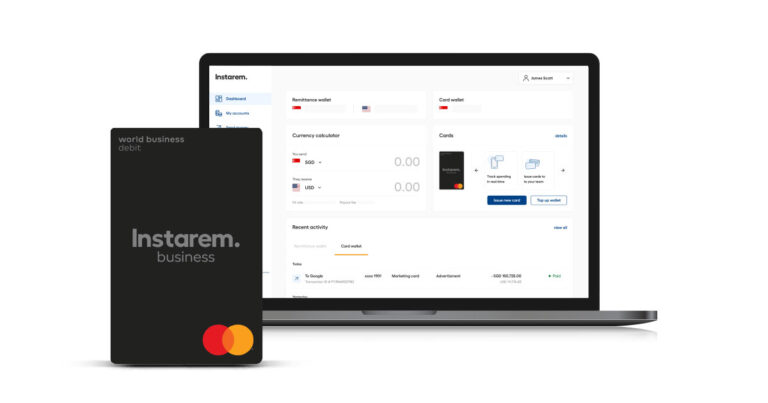

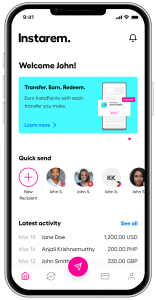

Sending money overseas using Instarem

Before we wrap it up, do you know that if you are living abroad you can send your investment income back home using Instarem?

By using Instarem online money transfer services, you will be able to reduce the fees. Unlike conventional banks or money transfer kiosks, Instarem offers competitive currency exchange rates and fees for international money transfers.

In addition to that, Instarem has an interactive feature and tool; their currency exchange calculator. The calculator will automate the currency exchange value calculation for you.

So if you are looking for one way that you can save up and be more financially efficient, be sure to check out.

Download the app or sign up here.

Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.