POSB Singapore overseas money transfer: Everything you need to know

This article covers:

- How much does it cost to transfer money internationally with POSB?

- POSB foreign exchange rates

- Total costs to send money overseas (as of Dec 2021)

- Timing and limits for overseas funds transfer

- What is the process to make a transfer through POSB?

- Information needed to perform a transfer

- A cost effective way to send money overseas: Instarem

POSB, also known as the Post Office Savings Bank, is the oldest local bank in continuous operation in Singapore since 1877. POSB is now part of the consumer banking group under Singapore’s largest bank, DBS Bank, serving 4.6 million retail customers in Singapore after DBS acquired it in 1998 for S$1.6 billion.

The integration of both banks offers a wide range of financial products and services for its clients, including making international fund transfers. This rich history of the bank makes POSB remittance service to be more trustable than ever.

How much does it cost to transfer money internationally with POSB?

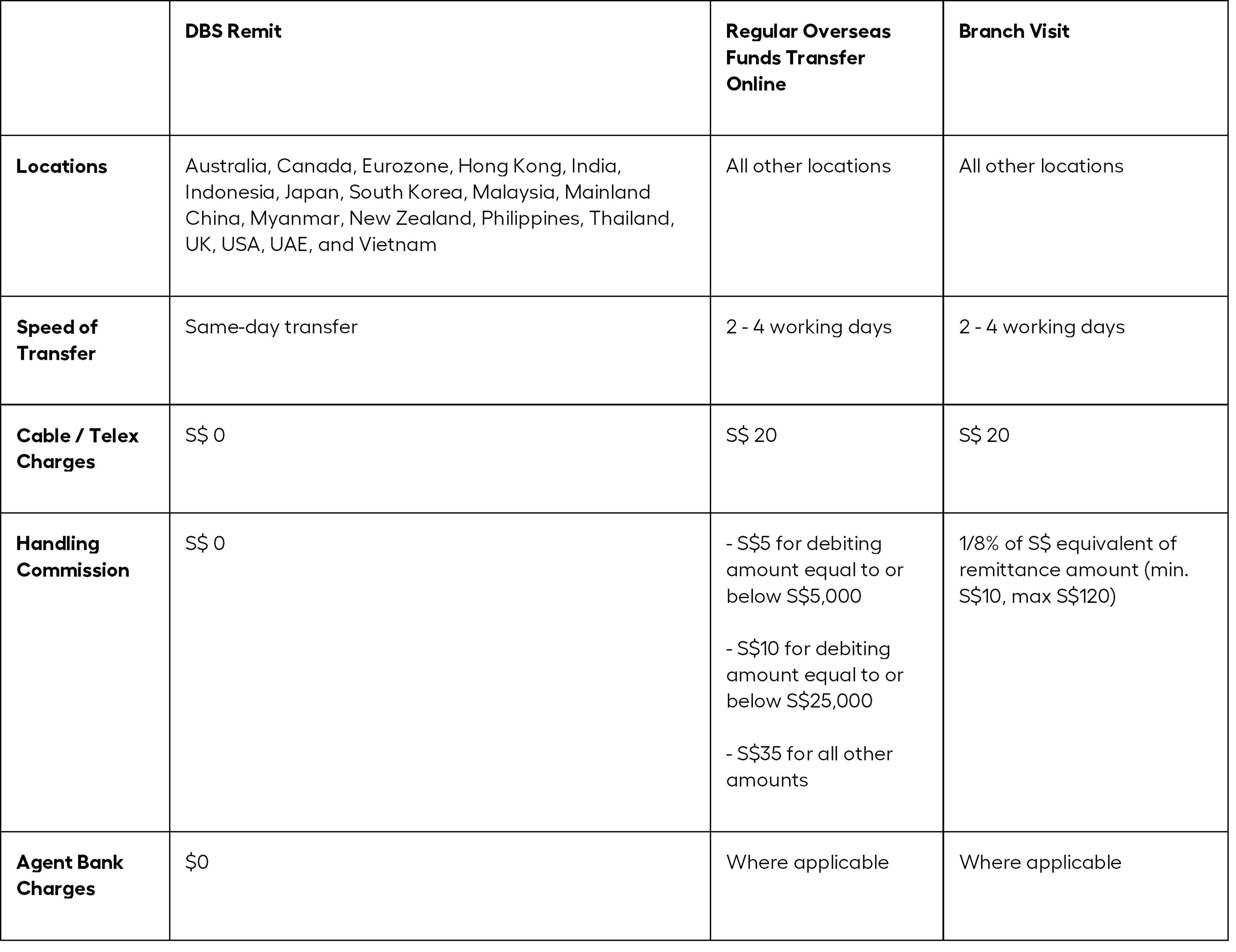

Before we move on to something deep, let’s get you started by looking at the types of POSB overseas transfers. Generally, there are three types of overseas transfers provided by POSB — DBS Remit, regular overseas funds transfer or telegraphic transfer online, and branch visits. To break it down further for you, we’ve created the table below.

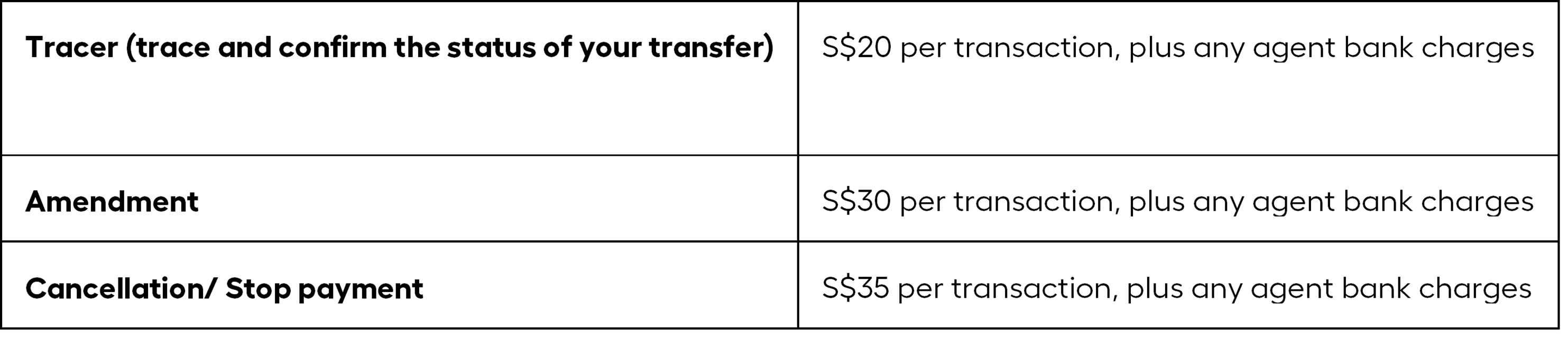

There are also other charges that you need to take note of:

As you can see, DBS Remit is often cheaper than your regular overseas fund transfer. Not only that, but DBS Remits also offers same-day transfer at 0 transfer fee for every location that allows DBS remit via digibank.

But what happens if your receiver’s location doesn’t have DBS Remit yet? If that’s the case, certain fees such as cable and handling charges, as well as agent bank charges, may apply per transfer.

POSB foreign exchange rates

POSB remittance service seems great, doesn’t it? If we take a look at DBS Remit, it provides same-day transfer, but it also has 0 charges on cable/telex changes, handling commission, and agent bank charges compared to other POSB overseas transfer methods, which has quite a number of charges.

POSB remittance service may appear to be a cheaper option at first, it however comes with a hefty exchange rate. The banks’ markup on the exchange rate, which is usually higher than the mid-market rate (the rate you see on Google), could also be higher than the rates offered by other remittance platforms.

POSB, however, does mention that their DBS Remit & OTT service comes with preferential rates if you’re ever sending up to SGD 50,000 or more. But, even when you’re offered these `preferential rates,` the differences in the rates are relatively small.

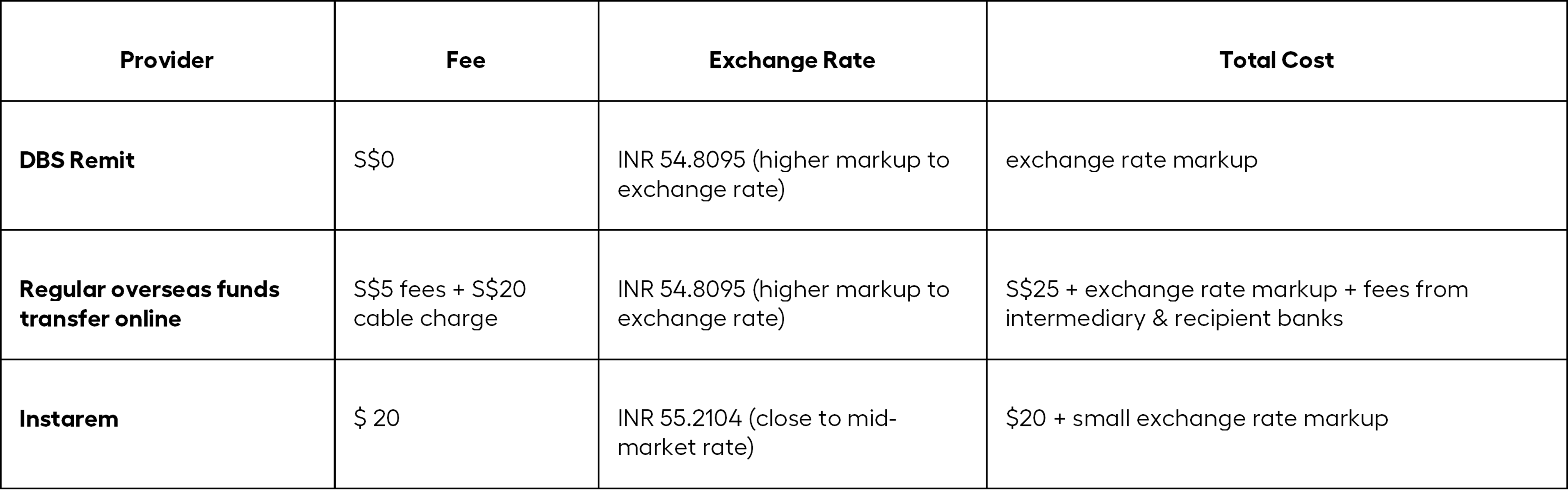

Total costs to send money overseas (as of Dec 2021)

So, now that you know a bit more about POSB and how it works, with all things considered, the POSB’s fee schedule makes the bank a costly option to perform an international money transfer transaction. Here’s an example of an online bank transfer sending S$1,000 to India:

Timing and limits for overseas funds transfer

Another factor that you should probably consider when sending money overseas is the transfer limit of the remittance service. The daily transfer limit of POSB remittance service is as high as S$200,000 except for Indonesia, with a smaller limit of USD 35,000, and South Korea of USD 20,000. If you need to perform a fund transfer that exceeds S$200,000, you will need to visit one of their branches to facilitate the transfer.

While regular overseas funds transfer will take 2 to 4 working days to complete, with DBS Remit, you can expect same-day delivery if the transaction is done before the cut-off timing on a business day, which is different for every market. Here are some of the cut-off times:

- Australia – 12:00pm

- Hong Kong – 4:30pm

- Malaysia – 2:00pm

- Japan – 10:30am

- United States – 5:00pm

- China – 3:00pm

What is the process to make a transfer through POSB?

There are a total of 4 ways to transfer money out of your POSB bank account.

1. DBS Remit

Via DBS Remit, you get to transfer money to countries such as the Philippines, Malaysia, India, China, Indonesia, Hong Kong, the US, UK, Australia, and the European countries with much faster and lower rates.

All you need to do is:

- Use the DBS Remit service through the POSB internet banking portal

- Click “Transfer – DBS Remit and Overseas Transfer,” select a country from their list

- Press enter and submit the recipient information along with the payment instructions.

2. POSB online transfer

As mentioned, certain countries have yet to get a hold on the DBS Remit services. If so, you can transfer your money overseas through telegraphic transfer via internet banking.

- Login to your POSB internet banking portal.

- Click “Transfer – DBS Remit and Overseas Transfer”, then click on “+ New Recipient.”

- Enter and submit the recipient’s information as required by POSB along with their banking details.

- Return to the Transfer page, find the recipient’s name on the right side of the panel, and click “Transfer.”

- Select your account, enter the currency, and the amount you’re to transfer.

- Enter the 2-factor authentication PIN to ensure your transaction, and you’re good to go!

3. Using your POSB account online through Instarem

Aside from POSB overseas transfer and remittance services, you can also choose to employ money remittance services such as Instarem to help transfer your money overseas. Instarem is simple and easy to use. All you need to do is:

- Visit instarem.com

- Choose your local currency and the currency of your recipients.

- Make sure you’re satisfied with the cost and exchange rate

- Sign up for an account by filling up necessary personal information and documentation.

- Enter your recipient’s local banking info.

- Choose the best payment options for your transfer and send the money.

4. Visit a POSB branch

The more direct or physical way to transfer funds overseas is to do so at the POSB branch. All you need is your identity card or passport and your ATM card or bank passbook for verification purposes.

After that, just fill in the telegraphic transfer form, hand it to the banker, wait for them to verify your identity, and confirm the transfer details.

Information needed to perform a transfer

If you’re planning on making an international money transfer directly through POSB, make sure to have all these details so that you don’t have to go back and forth with the transferring process.

- Beneficiary bank details:

- Make sure that you have the SWIFT code, country, address, and clearing code ready.

- Recipient details:

- Get the full name and account number of your recipients.

- Transfer details:

- The total amount and currency you’re transferring to.

- Indicate the purpose of the transfer:

- Why are you transferring this fund overseas?

A cost effective way to send money overseas: Instarem

With Instarem, you get to send money overseas at a more affordable rate and fees. Although Instarem does charge a small markup on the exchange rate, it is still very close to the mid-market rate and the full transparency from the service lets you know the exact cost during every transfer you are making.

Instarem is also strictly regulated by nine financial regulators across the globe which makes sending money from Instarem safe and reliable. Lastly, you’ll also get to earn InstaPoints, which can be redeemed as a discount on your future transfers.

See for yourself how Instarem works.

Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

Instarem stands at the forefront of international money transfer services, facilitating fast and secure transactions for both individuals and businesses. Our platform offers competitive exchange rates for popular currency pairs like USD to INR, SGD to INR, and AUD to INR. If you're looking to send money to India or transfer funds to any of 60+ global destinations, Instarem makes it easy for you. We are dedicated to simplifying cross-border payments, providing cutting-edge technology that support individuals and businesses alike in overcoming traditional fiscal barriers normally associated with banks. As a trusted and regulated brand under the umbrella of the Fintech Unicorn Nium Pte. Ltd., and its international subsidiaries, Instarem is your go-to for reliable global financial exchanges. Learn more about Instarem.