Rent in NYC: 9 tips to navigating the NYC rental maze

This article covers:

Moving to the Big Apple? It’s supposed to be fascinating, right?

Thanks to all those TV shows we grew up watching. But seriously, Monica from Friends couldn’t afford a house in Greenwich with her job! It’s a brutal reality that hits you hard when you arrive, especially if you’re coming from a bigger town.

And don’t get me started on the so-called ‘reasonable’ NY homes – maybe only folks from Hong Kong or Japan might find them acceptable. Even Mumbai homes are bigger and cheaper, can you believe it?

Not trying to crush your dreams but finding a rental home in New York City is just an infuriating challenge with the high demand and pathetic availability. Still, if you do some preparation and research, there’s a slim chance you might stumble upon something suitable and not completely drain your wallet.

Here are some tips (fingers crossed they’ll help)!

Set a budget

Now we have to determine a “realistic” budget that supposedly aligns with our financial situation. As if it’s that simple! because here’s the kicker, NYC rentals are so pricey, compared to other cities. So, brace yourself when you see those costs.

And let’s not forget about the utilities and extra expenses . And if you listen to the “experts” preaching that you shouldn’t spend more than 30% of your income on housing, do they have any clue about the reality of living in NYC?

Of course, the 30% rule is a general guideline, and individual circumstances can vary.

In high-cost cities like New York City, it may be challenging to stick to this rule due to the expensive housing market. In such cases, it becomes even more crucial to carefully evaluate your budget, prioritize expenses, and explore various housing options to find a balance that works best for your specific situation.

Research neighborhoods

When moving, you must consider everything about your new neighbourhood: how close it is to work, the public transportation, safety, amenities, and more.

But here’s the deal, and listen up because this is especially important for NYC: you better do your research on these neighborhoods. The city is an absolute jungle, and one wrong move could mean you end up spending half your life stuck in traffic or dealing with delays on the subway. And good luck finding a place that doesn’t cost you an arm and a leg.

So, consider your commute time, think about the amenities you need to survive, make sure you’re safe because crime is a thing, and don’t forget to check if it’s close to your workplace or the fancy attractions you might want to visit.

Use online platforms

Before you go running from one apartment to another, feeling like a lost soul in this busy city, try this thing called the Internet.

Online platforms and real estate websites like Zillow, StreetEasy, Trulia, and Craigslist to name a few. Put in your preferences , like where you want to live, how much you can afford , and what type of place you’re looking for.

It’s not a magical solution for sure.And those photos might be deceiving, so beware. But at least you can get an idea of what the area is like and the estimated rental price. It helps you narrow down your options to a few ideal locations before you start running around from house to house for viewings. Trust me, it’ll save you some precious time and energy in this exhausting apartment hunt. Now, let’s just hope we find something decent fast. Good luck!

Work with a real estate agent

Feeling exhausted and overwhelmed with this whole apartment hunting thing? Consider getting yourself a real estate agent. They might make your life a little easier, show you available properties, try to negotiate lease terms, and all that jazz.

But here’s the catch: you will need to cough up some of your hard-earned cash for their services. Like, 50% of the first month’s rent as a commission. This is usually split 50-50 between the landlord and you, the tenant. But hey, maybe it’s worth it. Think of it as an investment to save yourself from the headache of searching for a place on your own.

Let’s face it, you’re a newbie in this new city, everything you’re used to doing is ten times more difficult, so, if you can afford to throw some money at a real estate agent, it might just give you a bit of support and save you some difficulty.

You’ll probably need all the help you can get in this rental market, so, think about it – it could be the best decision you’ll make in this whole apartment hunting challenge.

Be prepared for the application process

We’re in a competitive game here, and it’s called the New York City rental market. You’ve found that dream apartment? Great! But don’t waste time overthinking it. In this city, things move at lightning speed, and you’re not the only one eyeing the place.

You’ve got 5, 10, maybe even more people, all chasing the same apartment, and it’s a race to the finish line. The winner takes it all, and the rest are left in the dust. So, get your game face on and be prepared to act like a champ!

When you see a property you love, don’t hesitate – act quickly. Have all your necessary documents ready to go: proof of income, bank statements, references, you name it. Don’t leave anything to chance because the clock is ticking, and the one who’s swift and well-prepared wins the prize.

If you take your time and don’t come prepared, you’re– back to square one with apartment hunting. And you don’t want to be the one left behind while others snag their dream pads. So, gear up, be fast, and let’s conquer this competitive rental game!

Consider Roommates. Just hear us out for a minute. Yes, having your own place is like a dream come true, but let’s face reality – it’s super expensive. So, if you’re drowning in rent prices and can’t keep up, don’t be too proud to consider getting roommates. Desperate times call for desperate measures, right?

Having a roof over your head is way more important than your pride. So, swallow that pride and think practically for a minute. Sharing a rental with roommates can save your sanity and your wallet. You can split those high costs and have a little breathing room.

Sure, it might sound like a desperate move, but you got to do what you got to do to survive in this city. Once the rent market stops acting like a rollercoaster, you can think about breaking off and having your own space again. But for now, find some compatible housemates. (You don’t want to end up living with someone who’s driving you crazy, singing “I see your true colors shining through,” right?)

Be mindful of additional costs

Rent is just the tip of the iceberg. There’s a whole bunch of other expenses lurking beneath the surface. I’m talking about utilities – you know, electricity, gas, water, and the Internet. Then there’s that pesky renter’s insurance too. Oh, and let’s not forget those potential building fees, like maintenance and amenities.

So, before you even think about celebrating finding a place, take a moment to factor in these additional costs. They can sneak up on you and throw your budget out the window. It’s exhausting, I know, but you goto be mindful and plan ahead. You don’t want any surprises when those bills start rolling in.

Save on transportation

Forget about all the hassles and expenses of owning a car in NYC. Instead, you can save a ton on transportation by living near your workplace or close to public transportation. Everyone takes public transport, so you’ll fit right in.

You may want to also consider Jersey City, Hoboken, Brooklyn, Long Island City, or Yonkers, depending on where you work. You won’t believe it, but you might just stumble upon some affordable homes in these areas. And the cherry on top? They have direct access by train to Downtown or Midtown.

So, say goodbye to car troubles and hello to easy commuting with the Subway system. It’s a sigh of relief knowing you can save on costs and still have access to these awesome neighboring spots. Life just got a whole lot easier, my friend!

Credit score is important

Let’s face it, an expat with no credit score, you’re in for a bit of a challenge when it comes to renting a home. Landlords usually heavily rely on credit scores to gauge your financial responsibility but don’t worry, it’s not impossible to secure a rental.

You’ll just need to explore alternative ways to prove your reliability and show landlords that you’re a trustworthy tenant. It might take some extra effort, but hey, we’ve got some tips for you:

- Proof of Income: To demonstrate your ability to pay rent regularly, provide the landlord with proof of income. You can use pay stubs, employment contracts, or bank statements as evidence of your stable source of income. This will show them that you’re financially capable of meeting the rental obligations.

- Offer a Larger Security Deposit: If you lack a credit score, you can ease the landlord’s concerns by offering a larger security deposit upfront. This shows them that you’re committed and financially responsible, helping to address any doubts they may have about your financial standing.

- Provide Rental References: These references should highlight your positive rental history and how you maintained a good relationship with your previous landlords. For instance, we provided details of our Dubai landlord along with rental payment invoices to vouch for our track record as responsible tenants. This can significantly boost your chances of securing a new rental home.

- Show Bank Statements: These statements will serve as proof that you have sufficient savings to cover several months’ worth of rent, just in case it’s required. This reassures the landlord that you have the means to handle any unexpected situations that may arise during your tenancy.

- Offer a Letter of Explanation: Honestly explain your situation as an expat and the reason behind not having a credit score. Assure the landlord that despite this, you are financially responsible and fully committed to fulfilling all your rental obligations. This letter can help provide clarity and build trust with the landlord, showing them that you are a reliable and conscientious tenant.

- Use a Rental Guarantee Service: They act as an intermediary between you and the landlord. These companies provide a financial guarantee to the landlord, assuring them that in case of non-payment, they will step in and cover the rent. This added layer of security gives the landlord more confidence in renting to you. Although we didn’t require such a service, I’ve heard that it can be helpful for some individuals in securing a rental agreement.

Settling down can be a daunting experience, especially if it’s your first time…

Don’t worry, the process is well-regulated and organized, making it quite standardized. While managing costs in New York City might be challenging, don’t lose hope. With careful planning, thorough research, and responsible budgeting, you can find the perfect rental home that meets your needs and ensures financial stability during your stay. Take it one step at a time, and you’ll navigate through this with ease. You’ve got this!

Before you go…

Before you head out, we have one more tip to share with you. Managing rental money can be a headache, we know. There is also the constant worry of balancing your needs with supporting your family back home. It can be overwhelming.

Enter Instarem, to help you with managing your money.

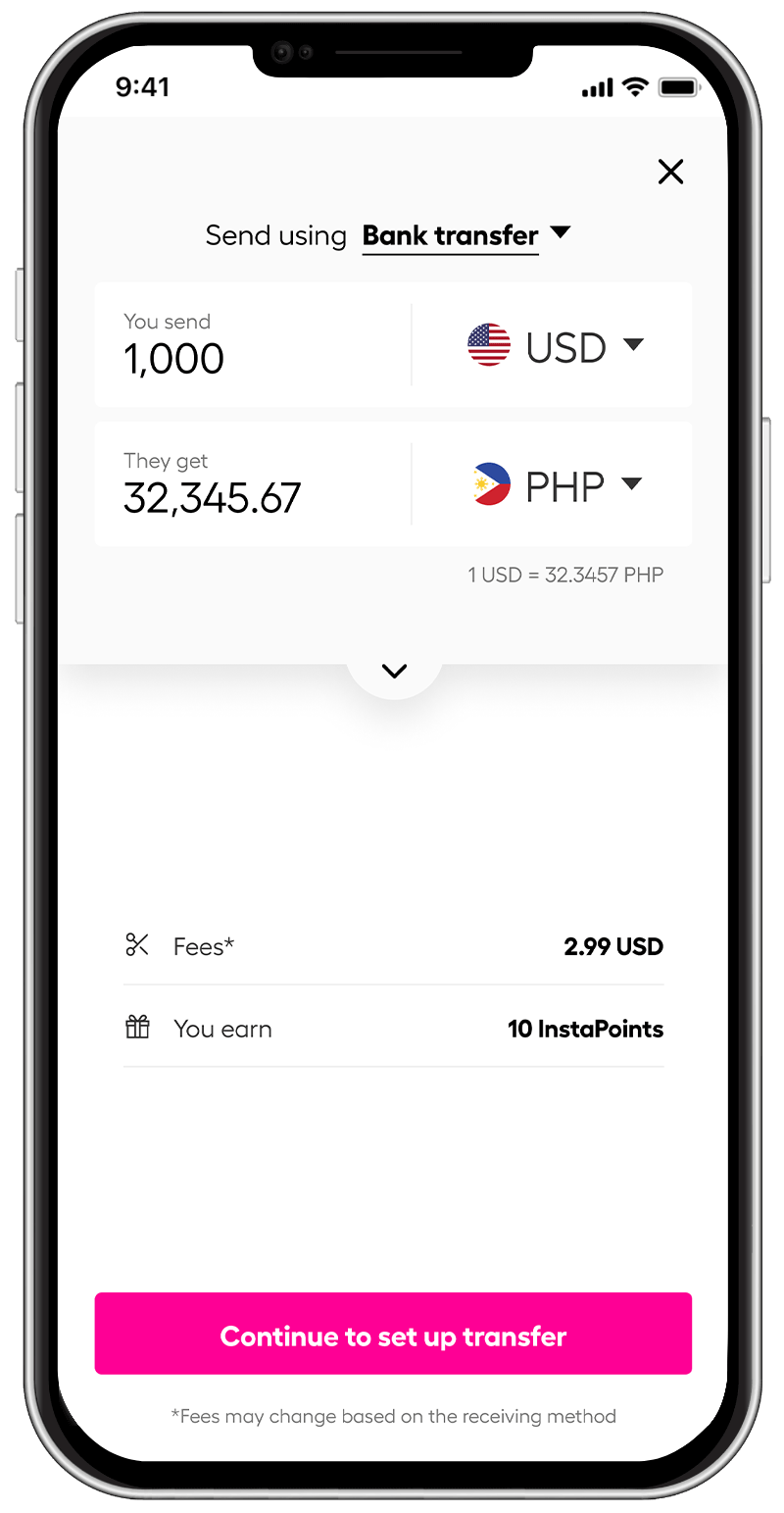

*rates are for display purposes only.

Send money from the USA can be simple with Instarem. You get great exchange rates and very low fees, making sending money back home a complete breeze!

Give Instarem a try for your next transfer. Leave those money worries behind and enjoy a sense of relief knowing your loved ones are taken care of.

Simply download the app or sign up right here.

Get the app

Get the app