This article covers:

- Wire Transfer: Meaning

- Direct Deposit: Meaning

- Wire Transfer Vs. Direct Deposit: Key Differences

- When to use wire transfers?

- When to use direct deposit?

- Security considerations involved in wire transfer and direct deposit

- Wire Transfer Vs. Direct Deposit: Fee and cost comparison

- Which is better: Direct Deposit or Wire Transfer?

- Conclusion

Be it individuals or businesses, sending money through electronic fund transfer systems (EFTs) has become an accessible and straightforward way for all. Since there are different forms of electronic payments, it may get confusing for many. Two of the most popular ETFs are wire transfer and direct deposit. A common confusion that arises – is wire transfer the same as direct deposit?

The answer is NO, so it is essential to understand the difference between these transfer methods to avoid making mistakes when electronically transferring funds.

In the article below, we shall explore the difference between direct deposit and wire transfer and which is better for you.

Wire Transfer: Meaning

A wire transfer is one of the fastest ways to send or receive money electronically from any bank account, within the geographical boundary, or overseas. This service can be availed through banks or financial institutions, or money transfer service providers.

Wire transfers can be domestic or international and facilitated through banks or other service providers. They are processed through a secure system like SWIFT (Society for Worldwide Interbank Financial Telecommunication) or Fedwire (for US markets).

Wire transfers are especially preferred when speed is the main objective or transfers are for a large sum. For example, they are the ideal choice if one wishes to make a down payment for a property.

Direct Deposit: Meaning

Many may need clarification and think, is direct deposit a wire transfer? However, a direct deposit is another ETF that aids in quickly transferring money. These transfers are generally run through an electronic clearing network.

For example, ACH (Automatic Clearing House) is used in the US, BACS (Bankers’ Automated Clearing System) in the UK; ECS (Electronic Clearance Service) in India, SEPA (Single Euro Payments Area) in the EU, etc.

Direct deposits are restricted to domestic banking systems and only deal with local currencies. For example, an individual in Canada can only receive a salary in CAD, or one in Europe can only receive payment in EUR through their respective EFT system.

The direct deposit method is generally considered safer since the funds are cleared through a centralized clearing house, reducing the chances of fraud and scams.

Wire Transfer Vs. Direct Deposit: Key Differences

Let us look at some of the key differences between wire transfers and direct deposits.

Parameter | Direct Deposit | Wire Transfer |

Ideal for | Recurring and small-value transactions | One-time and high-value transactions |

Reach | Domestic | Domestic and international |

Currency | Receive payments in only local currency | Can choose to receive payment in non-domestic currency |

Transaction speed | May take a longer time to complete processing | Quick even for international transfers |

Security | More secure as external clearing houses are involved | More prone to fraud and scams |

Reversibility | Due to longer processing time, it is possible to reverse the transaction. | Since the transfer is almost instant, reversing the transaction can be extremely challenging. |

Fund availability | Funds appear in “pending” status and can be accessed only after clearance | Can be used almost instantly |

Transaction cost | Very low, even zero in some cases | Wire transfer fees are generally higher |

Transfer limits | Lower transaction limits | Higher transaction limits |

When to use wire transfers?

Wire transfers are common for both domestic and international use. However, it is preferred for international money transfers since exchanging for a foreign currency is easier.

Instances when wire transfer is preferred are:

- If you need to transfer funds immediately: Wire transfers are renowned for their speed. Most domestic transfers are processed within the same day, whereas international transfers are quick with wire transfers. Depending on the recipient’s country, they may be completed within a few days.

- If you need to transfer large amounts of funds: Although wire transfers are subject to certain transaction limits, these limits are typically very high. Thus, you can send large amounts of funds, domestically or overseas, within a short turnaround time.

- If you need easy currency exchange options: Most wire transfer services offer currency conversion options; thus, if you wish to wire money internationally, you are aware of how much funds you transfer vis-à-vis how much the beneficiary receives.

When to use direct deposit?

Direct deposits are a popular way for businesses and organizations to deposit money into their employees’ accounts.

Situations where direct transfer through a bank or other providers may be preferred are:

- If you want to send money domestically: Direct deposits typically operate only within geographical boundaries, so a direct deposit is a good option if you wish to send money within your country.

- If you have to send or receive regular payments: Direct deposits are convenient and cost-effective. Hence, direct deposits are the best option for individuals or businesses who indulge in regular money transfers.

- If you wish to send a small amount of funds to multiple accounts: Similar to the point discussed earlier, direct deposits are ideal for small amounts of transfer due to less processing fees and also lower transfer limits.

- If there is no urgency of payment: Since direct deposit may take a longer processing time than a wire transfer, it should be preferred if funds are not required urgently.

Security considerations involved in wire transfer and direct deposit

Both wire transfers and direct deposits adhere to domestic and internationally recognized and regulated rules and safety networks. However, being electronic transfers, they both have their share of security challenges. Security is a major concern for wire transfers.

According to the 2022 Trends and Industry Forecast report by CERTIFID, around USD 1.4 billion is suspected in wire transfer frauds during 2022 across all processed transactions in the United States. The same report also suggests that there have been 145& year-on-year increases in these wire fraud instances.

The main reason why wire transfers are more prone to fraud is that they can be received anonymously through non-banking institutions. Moreover, they are non-reversible in contrast to direct deposits.

Here are a few tips to ensure security while transfer of funds:

- Use a reputable bank, financial institution, or service provider

- For online money transfers, ensure the device does not have malicious software

- Avoid using a public computer for remittance and always use a secure internet connection

Verify the recipient’s details, including account information, before making a payment - Do not share your account details, password, etc., with anyone; always keep it confidential and secure

- Stay alert and monitor your account for any unauthorized transactions

Wire Transfer Vs. Direct Deposit: Fee and cost comparison

Besides transfer speed, one significant difference between wire transfers and direct deposits is the cost. Wiring is an expensive process for both domestic and international transfers. Typically, a wire transfer fee in the US will range between USD 15 to USD 50. Various factors affect wire transfer fees. Additionally, banks or service providers may charge both incoming and outgoing fees for domestic and international transfers. There may be some hidden charges with regard to intermediary bank fees as well, depending on the type of transfer.

In comparison, direct deposit is a much cheaper option, and the transfer fee can be meagre. Banks transfer direct deposits, and some service providers may even do it free of cost in some cases.

Which is better: Direct Deposit or Wire Transfer?

Direct deposits are not necessarily better than wire transfers or vice versa. They both address the same objective- of transferring money. However, to decide to select the best payment method, you must evaluate the following four aspects:

- Speed: If you need to send or receive money urgently, domestic or overseas, and in larger amounts, a wire transfer should be your choice.

- Cost: Speed comes at a cost, and wire transfer fees can be pretty high compared to direct deposits; hence never ignore the cost aspect.

- Fund limit: Wire transfers are best suited to more significant transaction amounts, whereas direct deposits are preferred for small recurring payments. Direct deposits should be your go-to option if you run a business and must transfer salaries to your employees monthly. Additionally, direct deposit requires minimum paperwork, especially for recurring transactions.

- Security: Although both transfer modes offer the sender and receiver security, direct deposits offer an extra layer of protection. Hence, conservative customers typically opt for direct deposits.

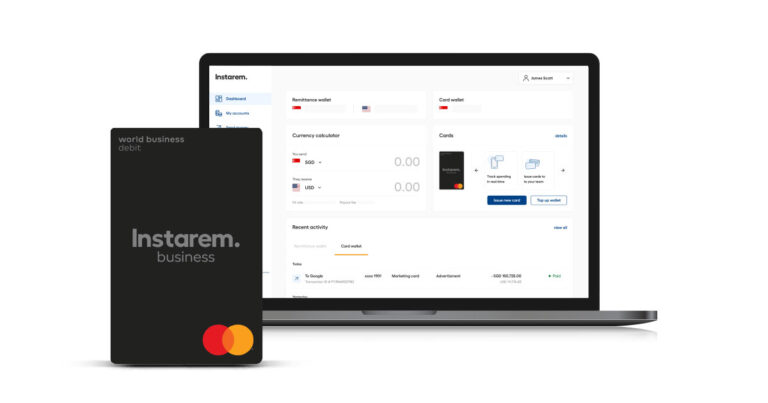

Wire transfers and direct deposits are popular methods of transferring money internationally. However, for faster transaction processing**, better foreign exchange rates, and competitive fees***, consider using specialist and reliable transfer providers like Instarem. Download the app or sign up here.

Conclusion

Wire transfers are an electronic means of transferring money domestically or overseas between banks or credit unions. On the other hand, direct deposits send regular or recurring money within a country’s geographical boundary.

Although both wire transfer and direct deposit are very similar in principle, they both are used to transfer money, they are suitable for different circumstances, and the decision to pick one depends on a few factors, as discussed in the preceding section.

The bottom line is that both these methods have pros and cons, and you should weigh them accordingly depending on your personal or business requirements. You can choose the best payment method that meets your needs by understanding the differences between direct deposit and wire transfer.

This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with the products or vendors mentioned.

** Fast, meaning 75% of our transactions are completed in 15 minutes. Depending on the funding method.

***When it comes to affordable exchange rates and fees, it’s worth noting that the cost will vary depending on how you choose to fund your transactions. Credit card funding and bank transfer fees can differ significantly.