9 important questions to ask your employer before accepting a job offer overseas

This article covers:

- 1. Who will manage my visa requirements?

- 2. Will the cost of my flight be covered by the company?

- 3. Will I be provided with accommodation?

- 4. What kind of medical insurance will be provided?

- 5. Do you have any other international employees in the same company or same team?

- 6. How many paid leaves will be granted?

- 7. What kind of social life will I have abroad?

- 8. How much tax do I need to pay?

- 9. How much could I save over time?

- Don’t forget to put aside money to send back home

- And lastly, don’t let the excitement of working overseas cloud your judgment.

Are you thinking of accepting a job offer overseas? If so, it’s important to ask your employer some questions before making a decision. The job market can be unpredictable, and you don’t want to find yourself in a situation where you’re not happy with your job while living in a foreign country. In this blog post, we will discuss 9 questions that you should ask your potential employer before accepting a job offer overseas!

1. Who will manage my visa requirements?

When you’re relocating to a new country for work, many visa requirements need to be met. It’s important to know who will be responsible for managing your visa requirements. Will your employer be taking care of everything, or will you be expected to handle it yourself?

Some employers may aid with the visa process, but it’s always best to double-check and make sure that everything is taken care of before you make the move.

Here are some questions to bear in mind for more clarity on your visa.

Do I need to have a confirmed job?

Some visas might not be valid if you don’t have a confirmed job. Go through the documents and copy of your contract carefully before getting on a flight.

What type of visa do I need?

There are several work visas available. Make sure you obtain the visa that applies to you and be aware of the terms and conditions of the one that applies to you.

Can I travel once I reach the country of work?

The options to travel during off days during your working period are often available. It is always good to refer to your visa’s terms and conditions for more clarity.

Can I change employers?

Some work visas restrict you to one job. This means that once you leave your employer, you will also have to leave the country for a certain period.

How long is the visa valid?

Don’t let your visa expire or you might get into trouble. Depending on your job situation, you might need to do the paperwork to get it renewed or extended.

2. Will the cost of my flight be covered by the company?

When you’re relocating for work, it’s important to know whether your employer will be covering the cost of your flight. In some cases, employers will reimburse you for your flight after you’ve already purchased it. In other cases, they may arrange and pay for your flight in advance.

Some employers may also require you to sign a contract that states you will reimburse them for the cost of your flight if you decide to leave the company within a certain period.

If your employer is not covering the cost of your flight, you should ask about other relocation benefits that they may be willing to provide. These benefits could include help with finding housing, shipping your belongings, or paying for a visa.

3. Will I be provided with accommodation?

When you’re relocating for work, one of the most important things to consider is your accommodation.

In some cases, your employer may provide you with accommodation or help you to find a place to live. Or your employer might pay a portion of your accommodation cost.

In other cases, you may be expected to find your housing.

Here are some accommodation-related costs to take note of:

Rent

Amount to be paid every month. The period of rental is dependent on the rental agreement that you have signed.

Deposit

Upon arrival, the landlord might charge a sum by way of a security deposit which will be returned once the house or apartment is vacated after the lease period is over.

Pre-existing damages

Bring to the notice of the landlord any damages that might already exist to avoid any liabilities later on. Take pictures or make videos as proof.

4. What kind of medical insurance will be provided?

Falling sick when you are overseas and alone is not a great experience to go through. So make sure you have adequate medical insurance for emergencies.

In some cases, your employer may provide you with medical insurance or help you to obtain it. In other cases, you may be expected to find your insurance.

Here are some things to keep in mind when considering medical insurance:

- What type of coverage does the plan provide?

- How much will I have to pay out of pocket?

- What is the deductible?

- Are there any restrictions on pre-existing conditions?

- What is the network of providers?

It’s also a good idea to research the quality of healthcare in the country where you’ll be working. This will help you to know what to expect and whether you need to take extra steps to ensure your health and safety.

5. Do you have any other international employees in the same company or same team?

If you are the only international employee, you may feel isolated and have a more difficult time adjusting to your new workplace.

On the other hand, if there are other international employees in the company or on your team, you can ask them for advice and support.

You can also ask your employer if they have any programs or resources to help international employees adjust to their new workplace.

These programs or resources could include language classes, cultural training, or mentorship programs.

6. How many paid leaves will be granted?

Paid leave days are given so that employees can have a break from work, whether it is for vacation, sick days, or other personal reasons.

The number of paid leave days that you’re entitled to will vary depending on the country where you’re working and the company’s policies.

Some companies may offer more generous leave policies than others.

So if you’re considering accepting a job offer overseas, be sure to ask about the company’s leave policy.

You should also find out if there are any restrictions on taking leave, such as having to give notice or being required to take unpaid leave.

Asking about the company’s leave policy will help you to know what to expect and whether or not the job is a good fit for you.

You Might Also Like To Read: If You Are Staying In One Of These Countries, You Might Be Working Too Much!

7. What kind of social life will I have abroad?

You may be moving to a country where you don’t know anyone, so it’s important to find out about the social scene in the country where you’ll be working.

There are many ways to meet people in a new country, such as joining social clubs, taking language classes, or attending events.

You can also use social media to connect with people who share your interests.

By asking about the social scene in the country where you’ll be working, you can get an idea of what kind of social life you can expect to have.

8. How much tax do I need to pay?

Asking about taxes will help you plan your finances accordingly.

The amount of tax that you’ll need to pay will vary depending on the country where you’re working.

So if you’re considering accepting a job offer overseas, be sure to ask about the tax rates in the country where you’ll be working.

You should also find out if there are any deductions or exemptions that you may be eligible for.

Also, don’t forget to check if you still need to pay taxes in your home country. Countries like the United States have a taxation system that taxes their citizens on their global income, no matter where they reside.

By the end, you should be able to have a rough idea of how much money you’ll need to set aside each month to pay your taxes.

This will help you budget your finances and ensure that you have enough money to cover your tax bill.

9. How much could I save over time?

Don’t YOLO. You need to save for the future.

If you’re moving to a country with a lower cost of living, you may be able to save a significant amount of money over time.

On the other hand, if you’re moving to a country with a higher cost of living, you may need to adjust your budget accordingly.

Either way, it’s important to research the cost of living in the country where you’ll be working. This will help you plan your finances accordingly.

Here are some costs that you should consider:

- Rent

- Utilities

- Transportation

- Food

- Clothing

- Entertainment

By asking about the cost of living in the country where you’ll be working, you can get an idea of how much you’ll need to budget for your everyday expenses.

Don’t forget to put aside money to send back home

Use Instarem to send money back home for the following:

- to your loved ones,

- tax payments

- or even building your retirement funds.

Here are a couple of reasons to consider Instarem:

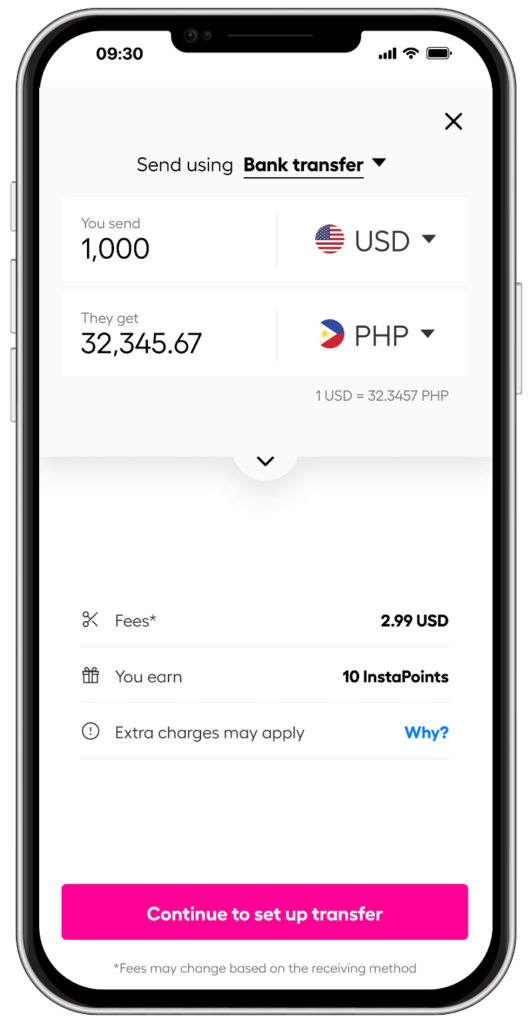

Cost-effective

Low transfer fees enable you to send money to multiple destinations without burning a hole in your pocket.

Easy and fast

Transferring money to other countries is typically an instant transaction.

Earn loyalty points

You will be rewarded with loyalty points which are referred to as ‘InstaPoints’ for every transaction and referral you make via Instarem. You will then be able to redeem your points and get great discounts for future transactions. Remember, the more you transfer, the more you earn!

Transparency

Absolutely no hidden costs. You will be in the know of the exact rates and fees applied to your money transfer.

*rates are for display purposes only.

Try Instarem for your next transfer.

Download the app or sign up here.

And lastly, don’t let the excitement of working overseas cloud your judgment.

Before accepting a job offer, be prepared for the following:

- Culture shock and homesickness.

- Get all your documentation in print

- Speak to someone who is currently working in the host country

Remember to have fun! Working overseas is an amazing experience that will help you to grow both professionally and personally.

We hope that this article has helped to answer some of your questions about working overseas.

Get the app

Get the app