Comparing best business accounts in Singapore for international money transfer

This article covers:

Conducting a business comes with the responsibility of managing finances, which can seem like a daunting task. But with the support of the right business account, your work can become much easier.

Business accounts often come with a wide range of functionalities that assist you in handling your business finances. However, business accounts in Singapore are available in various types and features. So, to make it easier for you, we will be comparing business accounts in this article. By the end, you will know which one would best suit your business.

How do business bank accounts work?

Business accounts are usually current or transaction accounts that specialize in handling business needs and finances. They provide benefits exclusively meant for businesses, such as multi-user access, added flexibility and security for overseas payments and fund transfers, batch payments, automation payrolls, and more. Having a business account can play a vital role in supporting and growing your business.

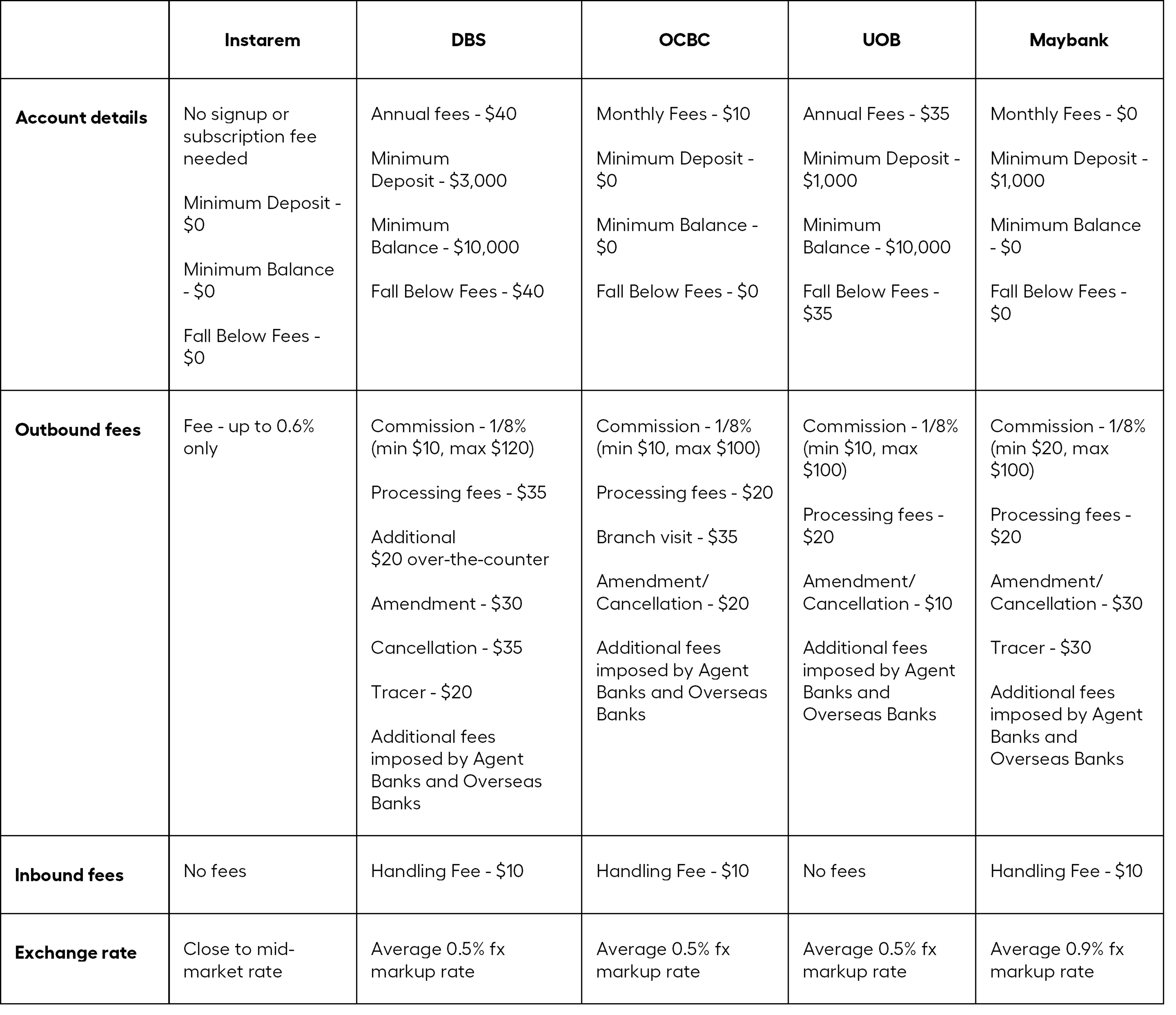

Comparing international money transfer from business accounts in Singapore

How to compare business accounts for international money transfer

Business accounts play an undeniable role in every business and are available in several different types. Therefore, it is important to carefully choose one that is best suited for your business, keeping in mind factors like banking fees, user access, and other features.

While comparing your options, the most important variables you must consider are:

- Security and compliance:

Sending money overseas often comes with one big worry: whether the transactions are secure. When choosing the right remittance provider, check if they take all the necessary precautions to transfer your money securely and if they comply with the highest possible security standards such as mandating a KYC process.

- Fees:

Financial institutions around the globe often charge their clients for the banking services they provide as well as account maintenance. These fees can be levied at various levels, including subscription fees, processing fees, transaction fees, cheque issuance and clearing fees, overdraft or excess fees, and more. The fees and rates can differ from one bank to another, making it important to choose a bank that charges an amount you’re able and willing to pay.

- Minimum deposit and balance:

Your choice of a business account must be made keeping in mind the minimum deposit and balance that you are required to maintain in your account at any time.

- User access:

Business account users operating a limited company often prefer a corporate account with multi-user access for managing expenses. Business accounts with multi-user access provide full access to authorised users, along with individual business debit cards.

- Limits on transfers and currency conversion fees:

While choosing a business account, it is important to consider the currency conversion fees and other limits on foreign transfers that the institution may impose.

- Extra features:

Other than the fundamental banking features, some business accounts come with extra features and added benefits like budgeting tools, payroll automation, expenditure tracking and analytics, and more, which can be beneficial to your business.

- Customer support:

Institutions and banking services that provide good customer support help maintain your business account and avoid inconveniences and banking errors.

An alternative way to sending money overseas: Instarem for business

Over the recent years, Instarem has grown as a pioneering digital payments platform operating globally. It is a convenient electronic medium for sending and receiving money and transferring funds at national and international levels. It improves operational efficiency for the overseas payments of staff salaries, rent, business suppliers, contractors, and more, using a cost efficient approach, great exchange rates and no hidden charges.

Instarem currently has a global reach of over 60 countries, multi-currency wallets, offers close to mid-market exchange rate, and comes with no hidden charges. In addition, Instarem provides quality of life services like the ability to manage global accounts from one dashboard, custom reports generation, and digital invoicing and tracking.

Furthermore, Instarem has made corporate payments smarter and easier with Instarem SEND where you can pay your subsidiaries, vendors, suppliers, and even freelancers through low-cost money transfers and competitive exchange rates.

How to open an Instarem for business account in Singapore?

Opening an Instarem for business account is extremely easy and convenient. All you need to do is prepare the relevant documents and follow the steps below to get started with your Instarem for business account.

- To get started with the process, you must first sign up or register with Instarem as a business account using your email address. If you have already signed up with Instarem, you can log in using your credentials.

- To open a business account, Instarem has mandated every user to provide a UEN number. Providing the UEN is crucial to the business account creation process, as it adheres to the regulatory requirements of Know Your Business (KYB).

- Once the documents have been uploaded, it will then be reviewed by Instarem’s internal team. Once the documents have been reviewed, it can take 1 to 3 business days for the application to be approved.

- If you require assistance with the onboarding, you can reach out to a member of our business team at [email protected]

- Instarem does not levy any signup or subscription fee for business accounts. There is no one-time account setup fee either. Instead, Instarem charges a transaction fee on every transaction made using the business account.

Instarem for business, with its benefits, functionalities and cost-effectiveness, helps your business grow, making it easier to manage business-related finances, and expand into new markets.

Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

Instarem stands at the forefront of international money transfer services, facilitating fast and secure transactions for both individuals and businesses. Our platform offers competitive exchange rates for popular currency pairs like USD to INR, SGD to INR, and AUD to INR. If you're looking to send money to India or transfer funds to any of 60+ global destinations, Instarem makes it easy for you. We are dedicated to simplifying cross-border payments, providing cutting-edge technology that support individuals and businesses alike in overcoming traditional fiscal barriers normally associated with banks. As a trusted and regulated brand under the umbrella of the Fintech Unicorn Nium Pte. Ltd., and its international subsidiaries, Instarem is your go-to for reliable global financial exchanges. Learn more about Instarem.