7 of the best credit cards for holiday shopping

This article covers:

Credit cards come with a variety of features, benefits, and rewards, making it difficult to choose just one as the best credit card for online shopping. To make things easier, Instarem’s amaze card allows you to combine 5 credit cards and use them as one. With the amaze card, you can enjoy fantastic FX rates with every overseas purchase. Plus earn InstaPoints on FX spends and redeem them as cashback or discounts on overseas money transfers.!

Wondering which 5 cards to link to your amaze card? Here are the 7 credit cards that we consider to be the best in providing you with the maximum benefits and are perfect for all your purchases during this holiday season.

DBS Woman’s World Credit Card

The DBS Woman’s World Credit Card is an entry-level Mastercard with a higher tier and premium benefits. These features make DBS Woman’s World Credit Card a popularly used credit card for online shopping.

What are the rewards available?

- Win up to 10x DBS Points (worth 20 miles) through online transactions (not inclusive of bill payments, government transactions, or prepaid account top-ups).

- Win 3x DBS Points (worth 6 miles) through overseas transactions and 1x DBS Point (worth 2 miles) with every online purchase of S$5.

- Additional 9x DBS Points for local purchases and 7x DBS Points for overseas purchases are rewarded at the end of the next calendar month. The points can be applied to the first S$2000 online transaction per calendar month.

- Interest-free payment plans as long as 6 months.

You can learn more about the reward structure from the terms and conditions.

What are the promotions available?

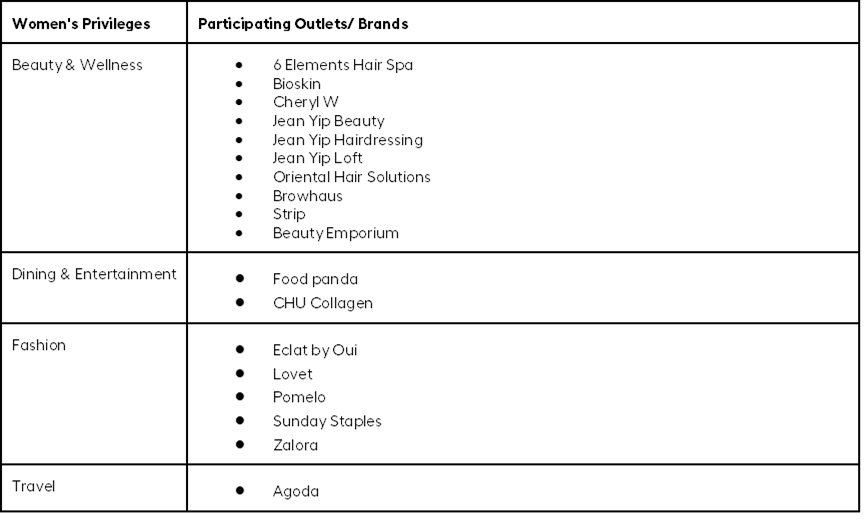

The DBS Woman’s World Credit Card hosts promotions from reputed brands in the categories mentioned below:

Citibank Rewards Card

Perhaps one of the more attractive credit cards in Singapore for Shopaholics, offering up to 10x rewards points (or $1 = 4 miles) when you shop online or completing certain offline purchases.

What are the rewards available?

With the Citibank Rewards Card, you get to enjoy the following rewards:

- Receive 30,000 Citi ThankYou points when you spend $3,000 in the first 3 months.

- 10x rewards (4 miles) on online shopping.

- 10x rewards (4 miles) on rides with Gojek, GrabCar, and more.

- 10x rewards (4 miles) on online food orders and delivery.

- 10x rewards (4 miles) on online grocery orders.

- 1x reward on all other retail expenses.

- Maximum flexibility while redeeming rewards through Citi ThankYou Rewards.

- Complimentary travel insurance when the payment is done using the Citibank Rewards Card.

What can you redeem from the Citibank rewards catalogue?

Your points expire in 5 years, which is why you have ample time to accumulate your points and redeem them for rewards from the Citibank rewards catalogue.

- Points and rewards can be redeemed at the Citi ThankYou Rewards website for NEX voucher. Your Citibank points can be redeemed for gift vouchers, hotel stays, as well as merchandise from leading brands across the world.

- Pay merchants online using reward points or miles.

- Shop with points from merchants like Amazon.

- Redeem Apple products using Citibank rewards and points.

- Instant point transfers.

- Cash rebates of up to $50 per redemption while using the Citibank Rewards Card.

- Petrol deals.

- Exciting everyday shopping deals, exclusive travel deals, and holiday season deals from Redmart, Deliveroo, Shopee, Foodpanda, Geneco, SIMMONS, and more.

What are the ongoing Rewards Credit Cards promotions?

- ZALORA — up to 22% off + 10% ZALORA cashback with min. spend. Valid till 31st Jan 2022.

- Island Kitchen Collective — 10% off orders with Promo Code CITI10. Valid till 31st Dec 2022.

- Love, Bonito — 10% off with min. spend online and in-stores. Valid till 28 Feb 2022.

Standard Chartered Unlimited Cashback Credit Card

At a flat 1.5% rebate rate with no minimum spend and no cashback cap, the Standard Chartered Unlimited Cashback Credit Card makes for one of the best credit cards for shopping this holiday season.

What are the benefits available?

- 1.5% cashback on every transaction made. No minimum spend is required and no cashback cap.

- If you make a credit card funds transfer, you can win up to S$20,000 cash and a chance for a 100% cashback on the processing fee. When activating the Standard Chartered Unlimited Cashback credit card, you will be rewarded an additional amount of S$120.

- Get up to S$280 cashback and 6 months of Disney+ subscription.

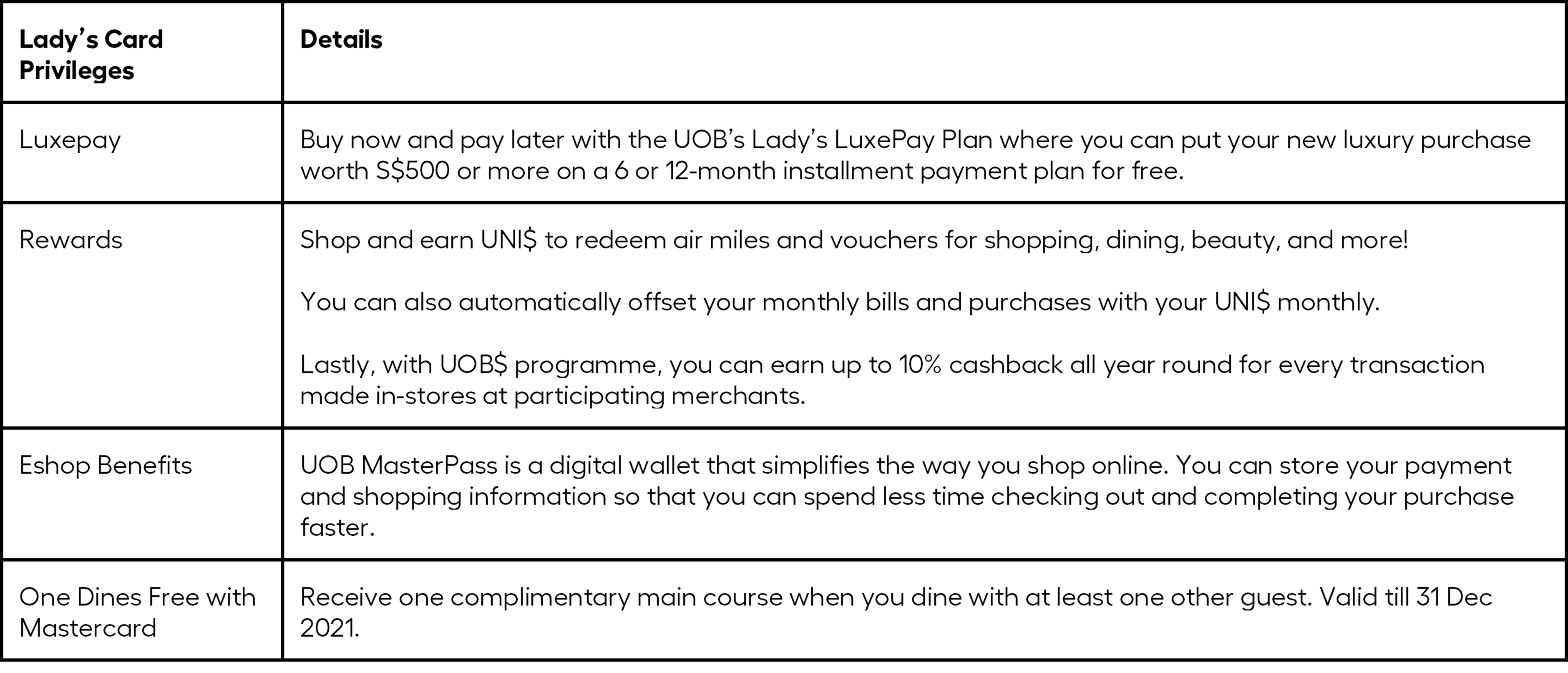

UOB Lady’s Card

Meant only for women, the UOB Lady’s Card offers a plethora of rewards.

What are the rewards available?

The UOB Lady’s Card comes with a substantial rewarding system for its users including:

- With no required minimum spend, earn 10x UNI$ (worth 20 miles) for every S$5 that you spend on chosen category(ies) including:

- Travel

- Fashion

- Dining

- Family

- Transport

- Entertainment

- Win 1x UNI$ (worth 2 miles) on every other transaction

- For purchases over S$500, you can get a payment plan spanning between 8 to 12 months with no interest charged.

What are the benefits available?

As a user of the UOB Lady’s Card, you can access special privileges like:

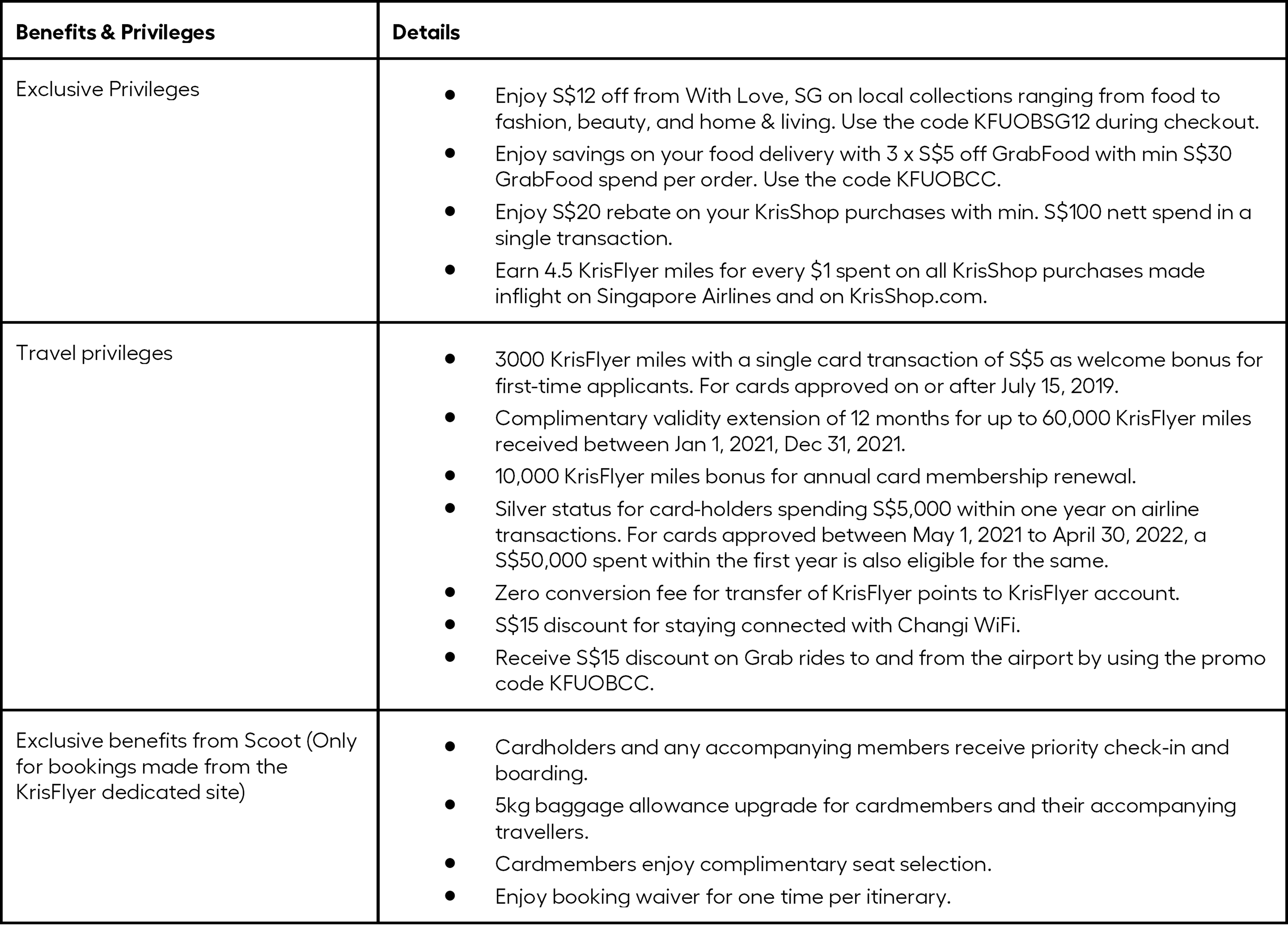

KrisFlyer UOB Credit Card

The KrisFlyer UOB Credit Card can be used as an Amex card that rewards miles based on your purchases.

What are the rewards available?

As a cardholder of the KrisFlyer UOB Credit Card, you can win special rewards like:

- 3 KrisFlyer mile added to your account for every S$1 expenditure from Singapore Airlines, Scoot, KrisShop.

- 1.2 KrisFlyer miles awarded for every S$1 spent on food delivery, dining, online shopping, travel, and transport. 3 miles awarded on a minimum of S$500 annual transaction from KrisShop and Singapore Airlines.

- 1.2 KrisFlyer miles added on any transaction of S$1.

What are the benefits available?

The KrisFlyer UOB Credit Card offers exclusive benefits and privileges including:

What are the promotions available?

The KrisFlyer UOB Credit Card also holds a myriad of special promotions for Travel, Dining and lifestyle

OCBC Titanium Rewards Credit Card

The KrisFlyer UOB Credit Card offers exclusive benefits and privileges including:

OCBC Singapore makes your holiday purchases easier with the OCBC Titanium Rewards Credit Card.

What are the rewards available?

- With every $5 you spend on eligible transactions and online purchases, you stand a chance to be rewarded 50 OCBC$ (worth 20 miles) up to 120,000 annually.

- A chance to win 5 OCBC$ for all other transactions.

- An additional cash rebate of 2% while spending at BEST Denki.

- Using your OCBC$, you can also win e-vouchers from STACK marketplace and redeem them for:

- S$10 ZALORA voucher

- S$50 FairPrice Voucher

- 10x S$5 Multi-use Grab Voucher

How to earn Bonus OCBC$

OCBC also rewards you with a bonus of OCBC$ based on your purchase. You can win up to 50 OCBC$ for every 5$ purchase in the shopping category when shopping from local as well as overseas stores.

Eligible Merchants

- Alibaba

- Daigou

- Mustafa Centre

- AliExpress

- Ezbuy

- Qoo10

- Amazon

- IKEA

- Shopee

- Courts

- Lazada

- Taobao

What are the available promotions?

If you are new to OCBC, the bank also has a welcome gift for you! All new cardholders are guaranteed to receive welcome gift vouchers worth up to S$300 from the loyalty platform STACK. You can also chance upon attractive $10 vouchers from brands like Kimage, Harry’s, Toast Box, Times, GNC, Andersen’s, and Earle Swensen.

HSBC Premier Mastercard Credit Card

The HSBC Premier Mastercard Credit Card grants you access to exclusive lounge visits, dinner deals, travel, and shopping offers.

What are the rewards available?

Using the HSBC Premier Mastercard Credit Card, you can win rewards including:

- 1 point for every dollar you spend. These points can be accumulated and redeemed for treats such as wine and dining, shopping, travel and leisure, as well as for home and electrical appliances. You can further use these points to pay fees and donate to charities.

- Travel privileges on flights, hotels, and local attractions.

- Lounge access sponsored by LoungeKey.

- Unlimited Wi-Fi Internet from Boingo.

- Privileges on dining, leisure attractions, hotels, and wellness. The HSBC Premier Mastercard Credit Card also rewards you with attractive bonuses from The Marmalade Pantry, Hoshino Coffee, Fat Cow, and many more.

What are the benefits available?

There are benefits galore with the HSBC Premier Mastercard Credit Card, including:

- 5% (up to SG$1,800) cash rebates on dining, food delivery, petrol, and transport (domestic as well as overseas) when spending over SD$600 in a single calendar month.

- Supplementary card for loved ones.

- No annual fee.

Excited to use these credit cards for the upcoming holiday season? Enjoy fantastic FX rates with every overseas purchase using the amaze card!

Singapore witnesses massive purchases around the holiday season, most of which are made with Mastercard. To help users with additional benefits during the holiday season, Instarem introduced amaze, a multi-purpose card that helps in sorting your purchases and maximizing your benefits. The amaze card brings to you the following benefits:

- Earn InstaPoints on FX spends and redeem them as cashback or discounts on overseas money transfers.

- It lets you link up to 5 debit and credit cards, which can be accessed with both the virtual and the physical amaze card.

- Provides you with Instarem benefits like great FX rates.

Mastercard benefits like Zero Liability Protection, ID Theft Protection, Global Emergency Services are also available with the amaze card. - Ability to link to Google Pay service.

- Can also be used for cashless, contactless payments for transport services at no additional charges.

- It’s completely free. It comes with no annual charges, processing fees, or top-up requirements.

Here’s how to get yourself an amaze card

Getting yourself an amaze card is easy with these 6 simple steps:

- Setting up Instarem: The Instarem app is available for free to download. You can also enjoy faster and easier onboarding during the sign up by using MyInfo with Singpass.

- Getting started with amaze: After signing up, you must complete setting up your Instarem account by clicking on the link shared through a confirmation email sent to your registered email ID. Once your account is set up you can start applying for your amaze card by choosing the card icon at the bottom of the Instarem app. Tapping on the card icon will promptly get you started on the application process.

- User Details: In this step, you will need to provide the name you wish to have on your amaze card and the address for the delivery of the card. Agree to the T&C by hitting ’confirm’ and you can start linking your Mastercard/s to your amaze card by adding the details.

- Virtual amaze Card: Once your Mastercard has been successfully linked, you can start using the virtual amaze card right away. The physical amaze card will be delivered to your address via snail mail within the next 7 to 14 working days.

- Activating the amaze card: Once delivered, you can activate your physical amaze card from the Instarem app. Tapping on the ‘Activate Physical Card’ followed by a card pin will activate the physical amaze card.

- Finishing up: You will be notified of the activation of your physical amaze card by a confirmation screen. You can now use the amaze card for all your holiday purchases!

So, what are you waiting for? Get your amaze card for free to spice up your purchases during this holiday season and enjoy attractive benefits!

*TnCs apply.

This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem is not associated with the promotions mentioned in this article.