Top 7 Revolut alternatives: Which suits you best? [2024 Update]

This article covers:

- Apps Similar To Revolut: 7 Revolut Alternatives Overview

- 1. Instarem

- 2. Wise

- 3. N26

- 4. Monzo

- 5. Remitly

- 6. PayPal

- 7. Panda Remit

- Fees, Transfer Time, Card Availability, and Payout Methods: How Does Each Revolut Alternative Differ?

- Best Alternative to Revolut Based on The Destination Country

- Looking for a Seamless and Low-Cost Global Transfers Solution? Instarem is The Answer

- Frequently asked questions

Revolut is one of the popular banking alternatives. It supports global payments to 150+ countries and has other interesting features like a spending tracker, cryptocurrency exchange, joint accounts, and more. With such valuable features, it’s no surprise that Revolut has 30+ million registered users.

Though the features offered by Revolut seem interesting, there are a few drawbacks inherent to it. That’s why we’re here to provide you with Revolut alternatives, which may suit you better depending on your needs.

In this article, we’ll discuss several apps similar to Revolut, which you can utilise to get features equivalent to those offered by Revolut. Let’s get into it and find the one that fits you best.

Apps Similar To Revolut: 7 Revolut Alternatives Overview

There are 7 apps similar to Revolut that you can choose from as an alternative. In this section, we’ll get to see the overview of each app, including:

- Instarem

- Wise

- N26

- Monzo

- Remitly

- PayPal

- Panda Remit

Make sure you read each overview carefully so you can make an informed decision based on your specific financial needs and preferences.

1. Instarem

The first worth-trying Revolut alternative is Instarem. Instarem is a Singapore-based global payment solution that supports international transfers across 60+ countries in 10 currencies with faster processing and cheaper costs than most banks.

Not only does it provide fast and low-cost transfers, but it also rewards you with InstaPoints for every completed transaction. Later, you can redeem them as cashback or discount vouchers for money transfers, making your global payments even cheaper.

Overall, it comes with two main account types: Instarem Personal and Instarem Business. The first one is designed to ease individuals in making daily transactions. While the latter caters to SMEs’ needs in making or receiving payments from global business partners.

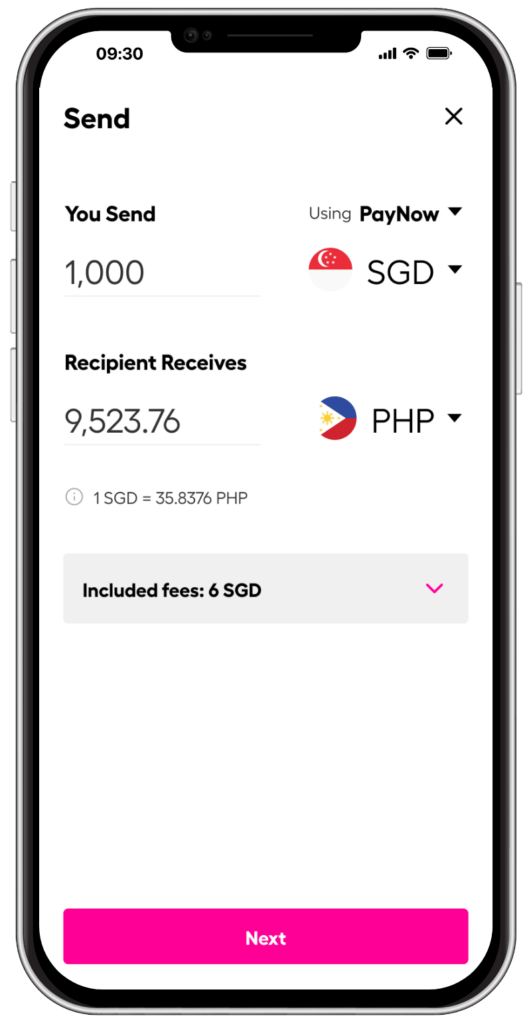

What makes Instarem truly special is that it offers transparent fees with zero markups on exchange rates. Its currency converter will estimate the cost of sending money and how much the recipient will earn, with no hidden charges to surprise you later on.

*rates are for display purposes only.

List of 36 Countries You Can Set Up an Instarem Account

- Australia

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hong Kong

- Hungary

- Iceland

- India

- Ireland

- Italy

- Latvia

- Lithuania

- Luxembourg

- Malaysia

- Malta

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Singapore

- Slovakia

- Slovenia

- Spain

- Sweden

- United Kingdom

- United States of America

How is it Different From Revolut?

In contrast to Revolut, which offers a wide range of finance services such as cryptocurrency exchange, interest savings, and joint accounts, Instarem focuses more on providing international money transfers with competitive exchange rates and low-cost fees.

If your needs mainly involve sending or receiving overseas funds, using Instarem may be more suitable. This way, you can seamlessly transact without having to navigate through unnecessary features.

Instarem Pros and Cons

Pros:

- Faster and cheaper than most banks

- Global coverage with transfers to 60+ countries in 10 currencies

- InstaPoints reward system

- Scheduled transfers (available in Singapore)

- Amaze card/multicurrency wallet (available in Singapore)

- Convenient funding methods (bank transfers, debit and credit cards, and PayNow)

Cons:

- Limited countries and currencies coverage

- Restrictions for users from certain countries to sign up

- The cash pickup option is only available in the Philippines

When to Use Instarem?

If you are a legal resident of one of the 36 countries listed, Instarem is an excellent choice for sending money abroad to 60+ regions in 10 currencies.

It provides you with mid-market exchange rates, no hidden charges, and low-cost transfer fees, saving your hard-earned money from being eaten away by high and often confusing bank fees.

2. Wise

Wise is a UK-based foreign exchange finance platform. Its primary service is to facilitate international transactions, whether for sending or receiving money. However, as needs change, it introduces additional features such as multicurrency accounts, direct debits, Wise cards, and more.

Wise stands out as a Revolut alternative due to its low and transparent transaction fees. Fees to send money to 80+ countries and 50+ currencies start at 0.4% of the total value with a competitive, mid-market exchange rate.

Additionally, the Wise card is just as popular as the Revolut card. With more regional coverage, the Wise card makes it much easier to travel to more countries and spend or withdraw cash there at lower fees than traditional banks.

Overall, Wise is very transparent about the fees it charges for sending money or topping up a Wise card. Before you make your payments, you can already see how much it’ll charge you, so there are no hidden fees to surprise you later on.

Where Can I Set Up A Wise Account From?

You can set up a Wise account in most of the countries around the world. But there are some regions where you can’t sign up or log in to a Wise account, including:

- Afghanistan

- Belarus

- Burundi

- Central African Republic

- Chad

- Congo

- Democratic Republic of the Congo

- Cuba

- Region of Crimea

- Eritrea

- Iran

- Iraq

- North Korea

- Libya

- Myanmar

- Somalia

- Republic of South Sudan

- Russia

- Sudan

- Syria

- Yemen

- Venezuela

- Ukraine regions: Donetsk, Luhansk, Kherson, Zaporizhzhia

How is it Different From Revolut?

Wise facilitates international transactions without additional features like those offered by Revolut. You won’t find features like investment, cryptocurrency exchange, or joint accounts on Wise.

Instead, Wise’s features are more focused on sending and receiving global money, using Wise cards, and saving money in multicurrency accounts. As a result, Wise is the best option if you want to carry out foreign exchange transactions easily without expecting additional services.

Wise Pros and Cons

Pros:

- Low-cost and transparent fees

- Mid-market exchange rate

- Ease to make direct bank transfers to 80+ countries

- Multi-currency account to hold 50+ currencies

Cons:

- Time-constraint customer support

- 48-hour limit on fixed exchange rates

- No cash pickups and mobile delivery options

- Limited currencies to receive in-app payments

When to Use Wise?

Wise is the all-in-one platform you can use whenever you need to send money to 80+ currencies and receive in-app payments in 12 currencies: AUD, CAD, EUR, GBP, NZD, MYR, PLN, SGD, USD, RON, HUF, and TRY.

You can also use its card when you’re travelling abroad. By using a Wise card, you can save more on exchange rates and spend like a local without the high fees conventional banks often charge you.

3. N26

N26 is a European-based digital bank that was licensed by the German Central Bank in 2016. N26 allows you to send money overseas seamlessly and offers similar features to Revolut, such as budgeting, split expenses, and cryptocurrency exchange.

Despite having features similar to Revolut, N26 stands out as an alternative by allowing integration with third-party apps like Wise. So, the transfer fees and exchange rates will follow what’s provided by Wise.

However, N26 is not entirely free of additional fees. There is a processing fee, which is typically 2%, depending on the transfer amount. You’ll be notified of these additional charges before making any payments with N26.

List of 23 Countries You Can Set Up an N26 Account

Since N26 is a European digital bank, most of its supported countries are in Europe, including:

- Austria

- Belgium

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Iceland

- Ireland

- Italy

- Liechtenstein

- Luxembourg

- The Netherlands

- Norway

- Poland

- Portugal

- Slovakia

- Spain

- Sweden

- Switzerland

- United States of America

How is it Different From Revolut?

N26 offers similar services as Revolut. However, there are some differences between the two. N26 only supports a limited number of countries, primarily those in Europe, unlike Revolut, which has a broader coverage, including the Asia Pacific and UAE markets.

By this, N26 makes an ideal alternative to Revolut only if you’re a legal resident and mostly reside in Europe. Otherwise, you might find Revolut to be a more suitable option due to its wider geographical reach.

N26 Pros and Cons

Pros:

- Aligned transfer fees and exchange rates with third-party apps

- Intuitive online banking features

- Low-cost overseas ATM withdrawals

- Travel insurance and lounge service

Cons:

- Limited to European and US residents

- Extra processing fees

- Limited support for the standard account

When to Use N26?

It’s only ideal to use N26 if you’re a legal resident of the US and one of the listed European countries. By using it, you can save more on fluctuating, often unfavourable exchange rates when spending abroad.

4. Monzo

Monzo is a UK-based mobile finance app that aims to simplify personal finance and management. It’s a Revolut alternative you can use for budgeting, allowing you to categorise expenses, set monthly limits, and receive alerts when budget thresholds are reached.

In addition, Monzo has some other interesting features. These include savings, which can be divided into different pots based on your goals, mobile payment integrations with Apple Pay or Google Pay, and joint accounts to split expenses with other Monzo users.

However, if you are looking to send money abroad, Monzo is not the solution. It only focuses on offering online banking services with extra features to simplify personal finance and management.

Where Can I Set Up a Monzo Account?

You can only set up a Monzo account if you’re a legal resident of the UK.

How is it Different From Revolut?

Monzo is a finance app tailored to simplify personal finance and management. On the other hand, Revolut caters to wider finance needs beyond money planning, encompassing international transfers, cryptocurrency exchange, and multi-currency accounts.

Monzo Pros and Cons

Pros:

- User-friendly interface

- Advanced budgeting tools

- Apple Pay and Google Pay integration

Cons:

- No international transfer option

- Limited for only UK residents

- Inflexible toward broader finance needs

- No bank branches

When to Use Monzo?

Monzo is a personal finance management app that is suitable for UK residents who want to take better control of their money. You can easily set monthly limits, track your spending, and save your hard-earned money in customisable pots.

5. Remitly

Remitly is a well-known global remittance service provider and a viable Revolut alternative. With Remitly, you can conveniently make international transfers to 170+ countries in 100+ currencies worldwide with low-cost fees and competitive exchange rates.

It charges transfer fees depending on the transfer values and the delivery speed you opt for; Express or Economy. The amount varies from a few dollars to completely free when you transfer above $500 with Economy delivery.

However, Remitly charges an extra 0.5% to 3% margin above the mid-market exchange rate. This means the total fees you need to pay depend highly on the currency involved. When sending money abroad, you may or may not end up paying lower fees than Revolut.

Even so, the fluctuating fees may be tolerable as Remitly offers convenience in the form of multiple payout methods. Remitly allows you to specify how your money should be received, such as bank deposits, cash pickups, and mobile wallets.

List of 30 Countries You Can Set Up a Remitly Account

Revolut provides seamless international transfers to 170+ countries in 100+ currencies worldwide, and you can begin enjoying the convenience if you’re a legal resident of the following countries:

- Australia

- Austria

- Belgium

- Canada

- Cyprus

- Czech Republic

- Denmark

- Finland

- France

- Germany

- Greece

- Ireland

- Italy

- Latvia

- Liechtenstein

- Lithuania

- Malta

- The Netherlands

- New Zealand

- Norway

- Poland

- Portugal

- Romania

- Singapore

- Slovakia

- Spain

- Sweden

- United Arab Emirates

- United Kingdom

- United States

How is it Different From Revolut?

Remitly differs from Revolut in its ability to send money to a wider range of countries and currencies. Though it lacks additional features such as an investment account, cryptocurrency exchange, and joint account, it remains valuable for people looking for a simple way to make international transfers.

Remitly Pros and Cons

Pros:

- Wide coverage with transfers to 170+ countries and 100+ currencies

- Flexible delivery options, including cash pickups, bank deposits, and mobile money

- Competitive exchange rates

Cons:

- High transfer fees to some currencies

- No money transfer calculation tool

- Restricted availability for users in certain countries to send money

- US$2,999 daily transfer limit

When to Use Remitly?

Use Remitly whenever you need a simple way to make international transfers, especially to less popular currencies. Remitly guarantees that your money will be delivered on time (within minutes with Express and 3 – 5 working days with Economy) and at a lower cost than conventional banks.

6. PayPal

PayPal is a digital payment service that you can consider as a Revolut alternative. It provides fast and secure transfers to and from 200+ countries in 25 currencies, making it a reliable option for sending money to PayPal users in less popular countries.

Aside from making money transfers easy, PayPal is also popular among its users for receiving money. After receiving funds in their PayPal accounts, they can immediately deposit them into their banks.

However, despite its wide coverage and ease of use, PayPal has its downsides. It’s notoriously known for its high fees and unfavourable exchange rates, which make many people turn to other viable options.

Where Can I Set Up a PayPal Account From?

You can set up a PayPal account from almost anywhere around the globe. However, restrictions apply to the following countries:

- Afghanistan

- Cuba

- Haiti

- Central African Republic

- Iran

- Iraq

- Libya

- North Korea

- Syria

- Liberia

How is it Different From Revolut?

The differences between PayPal and Revolut lie mainly in the services offered. PayPal focuses primarily on providing seamless solutions for sending and receiving funds between PayPal users.

While Revolut can do the same, it also includes features geared toward personal finance and management, such as investment, cryptocurrency trading, budgeting, and more.

PayPal Pros and Cons

Pros:

- Fast transfers

- Global coverage with transfers to 200+ countries

- Convenient for transfers to regular PayPal users

Cons:

- Expensive transfer fees

- Less competitive exchange rate

- No direct-to-bank transfer option

When to Use PayPal?

PayPal is one of the alternatives to Revolut for sending money abroad, particularly to regions that Revolut has yet to cover. It offers convenience in the form of fast and secure transfers despite the high fees and less competitive exchange rates.

7. Panda Remit

Panda Remit is a global remittance service that was first launched in Hong Kong. It offers competitive transfer fees and exchange rates for sending money to 40+ countries worldwide, making it a valuable Revolut alternative to consider.

Aside from providing affordable transfers, sending money abroad with Panda Remit is also fast. Transfers typically take 1 – 3 working days to complete, with the fastest transfer taking only 2 minutes.

List of 40 Countries You Can Setup a Panda Remit Account

- Canada

- United States

- Australia

- New Zealand

- Japan

- China

- Hong Kong, China

- Singapore

- South Korea

- United Kingdom

- Hungary

- Czech Republic

- Romania

- Denmark

- Poland

- Bulgaria

- Norway

- Sweden

- Italy

- Spain

- France

- Germany

- The Netherlands

- Greece

- Belgium

- Portugal

- Luxembourg

- Ireland

- Finland

- Lithuania

- Latvia

- Estonia

- Slovakia

- Croatia

- Austria

- Malta

- Cyprus

- Slovenia

- San Marino

- Brazil

How is it Different From Revolut?

As a Revolut alternative, Panda Remit differs in terms of the countries it supports. Revolut still supports fewer Asian countries than Panda Remit but is available in several Asian countries, including China, Japan, Hong Kong, Singapore, and South Korea.

Panda Remit Pros and Cons

Pros:

- Available in 40+ countries

- Fast transfers

- Fully licensed by Hong Kong’s MSO and Singapore’s MAS

Cons:

- Lack of fee transparency

- Restrictions for users from certain countries to register

- $100 minimum transfer limit

When to Use Panda Remit?

Panda Remit is ideal for sending money to the countries it supports. Despite its lack of transparency, the delivery time is relatively short.

Fees, Transfer Time, Card Availability, and Payout Methods: How Does Each Revolut Alternative Differ?

Still unsure about which Revolut alternative to choose? Let’s take a look at the following comparison, considering the fees, transfer time, card availability, and payout methods:

Provider | Fees | Transfer Time | Card Availability | Payout Options |

Revolut | 1.99% to other Revolut users, 2.49% of the value + US$0.60, subject to a minimum fee of US$1.30 for bank transfers, 2.49% of the value +US$0.60 for card transfers. | A few hours up to 3 working days, depending on the processing bank. | Digital and physical cards. | Direct-to-bank and between Revolut accounts. |

Instarem | 0.25% to 1% of the transfer value. | A few minutes to 1-2 days, depending on the destination country and currency. | Digital and physical card*. *available in Singapore. | Direct-to-bank and cash pickups*. *available in the Philippines |

Wise | From 0.4% of transfer value using bank transfers and Wise balance. | A few hours, up to a day. In rare cases, transfers can take 2 days. | Digital and physical cards. | Direct-to-bank and between Wise accounts*. *Only for supported currencies. |

N26 | Varies depending on the linked third-party services. | Varies depending on the linked third-party services. | Digital and physical cards. | Varies depending on the linked third-party services. |

Monzo | Varies depending on the linked third-party services. | Varies depending on the linked third-party services. | Digital and physical cards. | Varies depending on the linked third-party services. |

Remitly | US$1.99 for economy transfers and US$3.99 for express transfer | 3 – 5 business days for economy transfers, up to 4 hours for express transfers. | None. | Direct-to-bank, mobile wallets, and cash pickups. |

PayPal | 3.49% of the transfer value + US$0.49 fixed fee. | 30 minutes – 24 hours for transfers between PayPal accounts and 3 – 5 business days for direct-to-bank transfers. | Debit and credit card. | Direct-to-bank and between PayPal accounts. |

Panda Remit | 1.4% to 2.5% of the total transfer values. | Anywhere between a few minutes to 1 – 2 working days. | None. | Direct-to-bank. |

Best Alternative to Revolut Based on The Destination Country

Sending money to different countries and currencies may incur different fees and exchange rates. As a result, one Revolut alternative may not be suitable for all of your international transfers.

In the following, you can find Revolut alternatives based on the destination country you’re sending money to:

- India: There are multiple options you can send money to India with. But Instarem stands out as a top choice. It offers low-cost transfer fees, even free on your first transfer, and competitive exchange rates.

- United States: International wire to the US can cost so highly. But with Wise, you can transfer money there for much lower fees and better rates.

- Philippines: The Philippines is one of the top remittance destinations. Hence, many providers are vying for a share of the market there. Instarem is one option you can choose. It offers low-cost fees, competitive exchange rates, and a cash pickup option.

- United Arab Emirates: Many global payment solution providers are providing remittances to the UAE. Among the available options, you can choose Remitly for affordable and fast transfers.

Looking for a Seamless and Low-Cost Global Transfers Solution? Instarem is The Answer

Among Revolut alternatives, some of them offer low-cost transfer fees and competitive exchange rates. However, there is one provider that is second to none, namely Instarem.

Aside from the low-cost fees, Instarem also grants you extra rewards. After completing each transaction, you will receive InstaPoints, which you can redeem for cashback or discount vouchers for future payments, making transfers even more affordable.

We understand that everyone’s financial needs are unique, so Instarem offers two types of accounts: Instarem Personal and Instarem Business. The first caters to daily, usually smaller-value transactions, whereas the latter is designed to assist SMEs in simplifying global payments.

The choice is now yours, whether your needs are more suited to the individual or business account.

Still, have questions in mind? We’ll gladly help you out – contact us today!

Frequently asked questions

Is Revolut an online bank?

Revolut isn’t an online bank. Instead, they claim to be a digital bank alternative. They offer a range of online banking features, such as money transfers, physical and virtual cards, joint accounts, investments, and more.

Is there a better alternative to Revolut?

If Revolut’s services do not meet your needs, there is a better alternative. Simply adjust your expectations of a finance service. If you’re looking for a provider that offers low-cost and transparent international wire transfers, Instarem could be an alternative.

Are there any alternatives to the Revolut card?

Several global payment solutions provide cards, just like Revolut.

Here are the alternatives to the Revolut card you can choose from:

- amaze card: amaze card is issued by Instarem. If you’re a legal resident of Singapore you can use it to spend abroad without being charged high exchange rates by traditional banks.

- Wise card: Wise card is a pre-loaded debit card, available in virtual and physical forms. You can use it to spend abroad with lower fees and favourable exchange rates.

Which app is similar to Revolut?

There are numerous apps similar to Revolut. However, as Revolut provides an array of financial services, you must specify which specific features you want to look for among the alternatives.

If you’re looking for a similar app that provides international wire transfers, below are our recommendations:

- Instarem

- Wise

- Remitly

- PayPal

Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

Instarem stands at the forefront of international money transfer services, facilitating fast and secure transactions for both individuals and businesses. Our platform offers competitive exchange rates for popular currency pairs like USD to INR, SGD to INR, and AUD to INR. If you're looking to send money to India or transfer funds to any of 60+ global destinations, Instarem makes it easy for you. We are dedicated to simplifying cross-border payments, providing cutting-edge technology that support individuals and businesses alike in overcoming traditional fiscal barriers normally associated with banks. As a trusted and regulated brand under the umbrella of the Fintech Unicorn Nium Pte. Ltd., and its international subsidiaries, Instarem is your go-to for reliable global financial exchanges. Learn more about Instarem.