5 ways to build your budget to send kids to study abroad

This article covers:

- 1. Strategising early for your child’s international education

- 2. Recognising the gritty reality of expenses for overseas education

- 3. Brace yourself for inflation & exchange rates roller coaster

- 4. Unleash your inner wolf of Wall Street

- 5. Time to dial-up your friendly neighbourhood finance guru

- Before you go…

Welcome to the world of parenting!

It’s like signing up for a lifetime job with no vacations, endless responsibilities, and the unwritten rule that you’re obliged to pour all your hard-earned money into this little person who will, one day, fly off to explore the big, wide world. Oh, did we mention the part about praying fervently that they land on their feet when they do?

And the secret weapon to ensure they land on their feet? Education. As a parent, education feels less like a wise investment and more like buying a compulsory lottery ticket for your child! When we say ‘lottery ticket’, we mean that in today’s survival-of-the-fittest world, having a degree is like holding a VIP backstage pass to life’s concert. But the reality is getting that pass from your local university is becoming as tough as finding a needle in a haystack. So, what’s plan B? Studying abroad, of course!

But lo and behold, many parents are clueless about the future costs of sending their offspring to an overseas university. They’re lost in a maze of fees, living expenses, investment options, inflation, and exchange rates. As a result, many plans of ‘studying abroad’ remain just that — plans. Even if some parents manage to ship their kids abroad, their own future financial health hangs in the balance due to insufficient planning.

So here we are, with a handy list of financial planning ideas that you can use to make this whole process a tad less nail-biting and a lot more ‘goal-oriented’.

Because let’s face it, what’s the point of a plan if it doesn’t help you achieve your goals or make your life a smidge easier? The ultimate aim here is not just to fund your child’s education, but also to ensure that you don’t end up living off ramen noodles in your golden years.

So, buckle up, and let’s dive in!

1. Strategising early for your child’s international education

Alright, folks, listen up! We all know the saying, “The early bird gets the worm”, but let’s be real, we’re not talking about worms here. We’re talking about an international education for your kiddo. And no, this doesn’t mean you need to start a ramen noodle budget today. We still want you to enjoy your lattes and avocado toast.

So, where should you begin? Well, start by giving your spending habits a good ol’ reality check. Are you splurging on sushi dinners when you could be setting aside some cash for Junior’s education fund? Remember, a little bit saved regularly adds up over time. It’s like growing your own money tree, except it’s less leafy and more… well, money.

Now, unless you’ve been living under a rock, you know that making money grow involves more than just saving. You’ve got to invest, too. So, ask yourself: will saving a chunk of your paycheck cover your child’s future Oxford degree, or do you need to whip up a fancier financial concoction?

And speaking of Oxford, have you thought about where you’d like to send your offspring for their education? The cost of living in popular educational hotspots can make your wallet feel like it’s on a diet. So, consider countries like India, Mexico, Vietnam, or Nigeria, where the cost of living won’t give your bank account a heart attack.

In the end, remember, it’s always better to use your own dough for your child’s education. That way, you avoid getting tangled up in loans and debts, keeping your financial health in check. And who knows, you might even have enough left for that occasional sushi dinner!

2. Recognising the gritty reality of expenses for overseas education

Alright, brace yourselves. Studying abroad isn’t all about sipping lattes in Parisian cafes while pondering philosophy. It’s not just about tuition fees – you can’t exactly photosynthesise your way through college like a potted fern, can you?

You’ve got to factor in the less glamorous stuff too: student health insurance, academic supplies, and the cost of living (because apparently, landlords don’t accept knowledge as rent payment).

So, when you’re crunching numbers for your tot’s education, remember to budget for these extras. And don’t be shy – err on the side of overestimation. If your kiddo is still mastering the art of finger painting, by the time they’re ready for college, inflation will have done its thing and that dollar you’re clutching might not stretch as far as it does today.

Embracing this slightly gloomy outlook could actually boost your chances of building a savings pot that’ll cover future costs with room to spare. And the more you can squirrel away now, the less you’ll have to grovel to the banks for an education loan later. That means less debt, quicker repayment, and more freedom to enjoy your golden years without financial stress.

And hey, if you’re lucky enough to have any income rolling in during those post-retirement years, you’ll find your regular income plus lower repayment obligations equals a smoother ride into the sunset, free from financial headaches!

3. Brace yourself for inflation & exchange rates roller coaster

So, you’ve decided to send your little Einstein abroad for studies. But hold onto your calculators, folks because life has a sense of humour. The market crashes like a teenager after a sugar rush. Inflation skyrockets faster than your paycheck can say “Ouch”. And when you add the thrill ride of exchange rates, it’s like a never-ending math exam designed by your worst enemy.

If you’re from a developing country, it’s like playing a rigged game. You’re not just coughing up more dough compared to the mighty USD; you’re also battling the financial Goliaths – GBP, EUR, and AUD, among others.

But fear not, there’s a strategy you can employ. It involves studying past inflation and depreciation patterns. Use this data to estimate the potential increase in your country’s inflation and factor in the extra amount you need to stash away in your child’s education piggy bank.

4. Unleash your inner wolf of Wall Street

Let’s be real, your savings account isn’t going to cut it. You could live on a diet of instant noodles and tap water, but the rising cost of living will still laugh in your face. Thanks to our ‘friends’ inflation and exchange rates, the future looks more expensive than a designer coffee at an artisanal cafe.

So, unless you’re expecting a surprise inheritance from a long-lost relative, you need to find additional sources of funding now. And no, robbing a bank or winning a lottery doesn’t count.

Time to channel your inner Warren Buffet and understand your risk appetite. Are you a thrill-seeker or a play-it-safe kind of investor?

Look into medium and long-term investment options that you can start as soon as yesterday. Figure out where you stand in terms of risk and investment capability, and act accordingly. Mutual fund-based Systematic Investment Plans (SIP), education savings/investment plans, or education-specific insurance vehicles are some options to consider.

And remember, don’t put all your eggs in one basket. Diversify your investment portfolio like a buffet plate at a free brunch. Embracing a well-rounded strategy is all about future-proofing your finances. By shuffling assets like equity, debt, gold, real estate, and other tangibles, you can dance to the rhythms of local and global markets. It’s not just about numbers; it’s tuning into your risk vibes, spending patterns, and cash flow. It’s like playing chess with your money, but much more exciting.

5. Time to dial-up your friendly neighbourhood finance guru

If you’ve made it this far, congratulations! You’re either on the brink of a panic attack or about to throw away your kid’s future for a bag of magic beans.

Even if you’ve started early, crunched numbers like a math whiz. With so many researched investment options, you might still feel like a deer caught in the headlights. So what’s plan B? No, it’s not hoping your kid turns out to be the next Einstein and bags a full-ride scholarship.

It’s time to call in the experts.

Think of investment advisors and study abroad experts as your financial fairy godparents. They can help you navigate the murky waters of finance and education planning, and might even pull up options you didn’t know existed.

So, take a deep breath, pick up the phone, and let the professionals do their thing. Who knows, you might just get through this without selling your crown jewels.

Before you go…

Embracing the journey of studying abroad or waving goodbye as your child embarks on that adventure is a cocktail of emotions. It’s thrilling, heart-wrenching, and at times, feels like trying to solve a Rubik’s cube blindfolded.

One crucial puzzle piece in this grand adventure is finding the right partner for your overseas money transfers.

This is where Instarem steps.

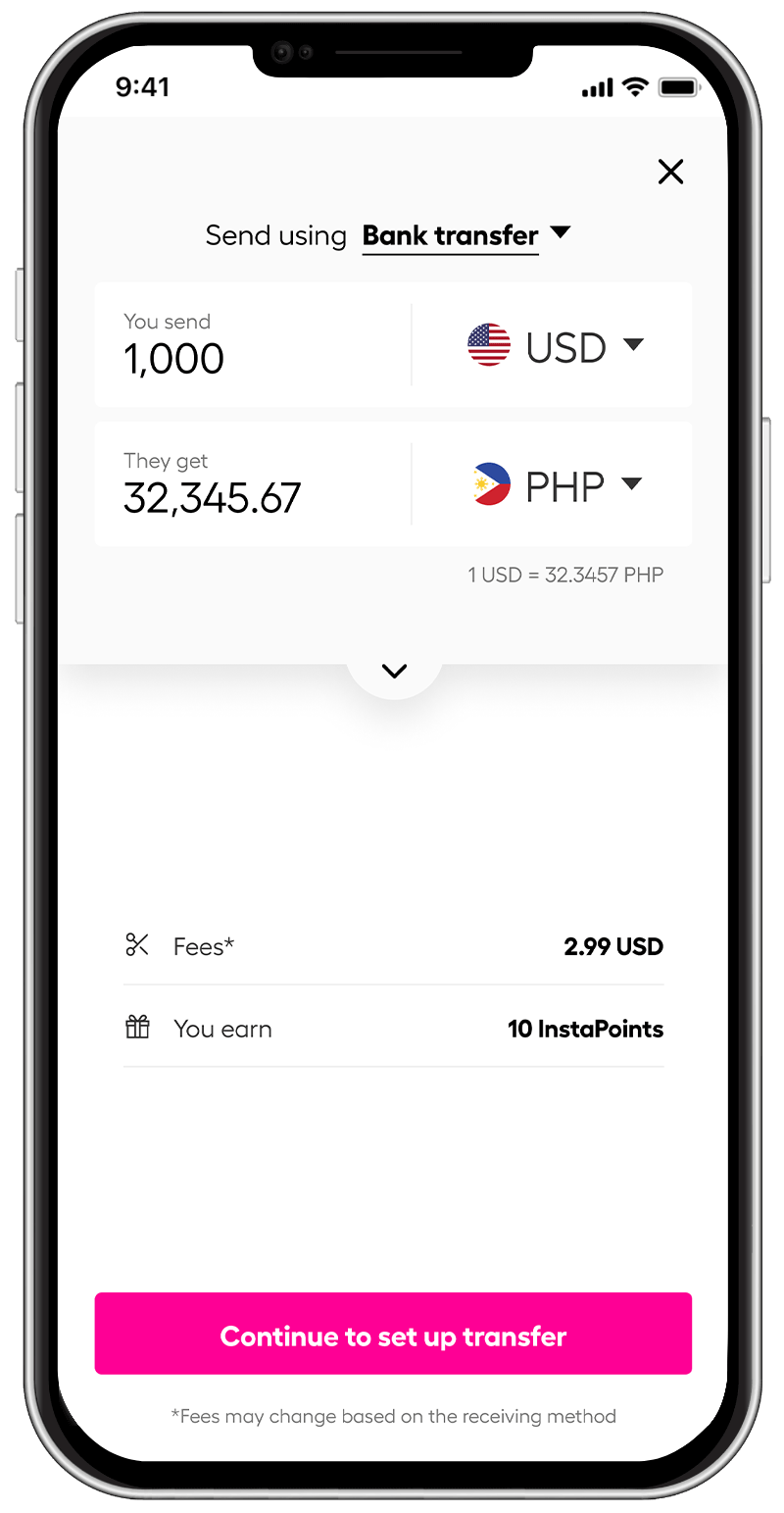

With minimal fees and competitive FX rates, to over 60 countries, Instarem makes international money transfers as easy as pie. If you’re hunting for a hassle-free, wallet-friendly method to send money abroad, Instarem is your knight in shining armour.

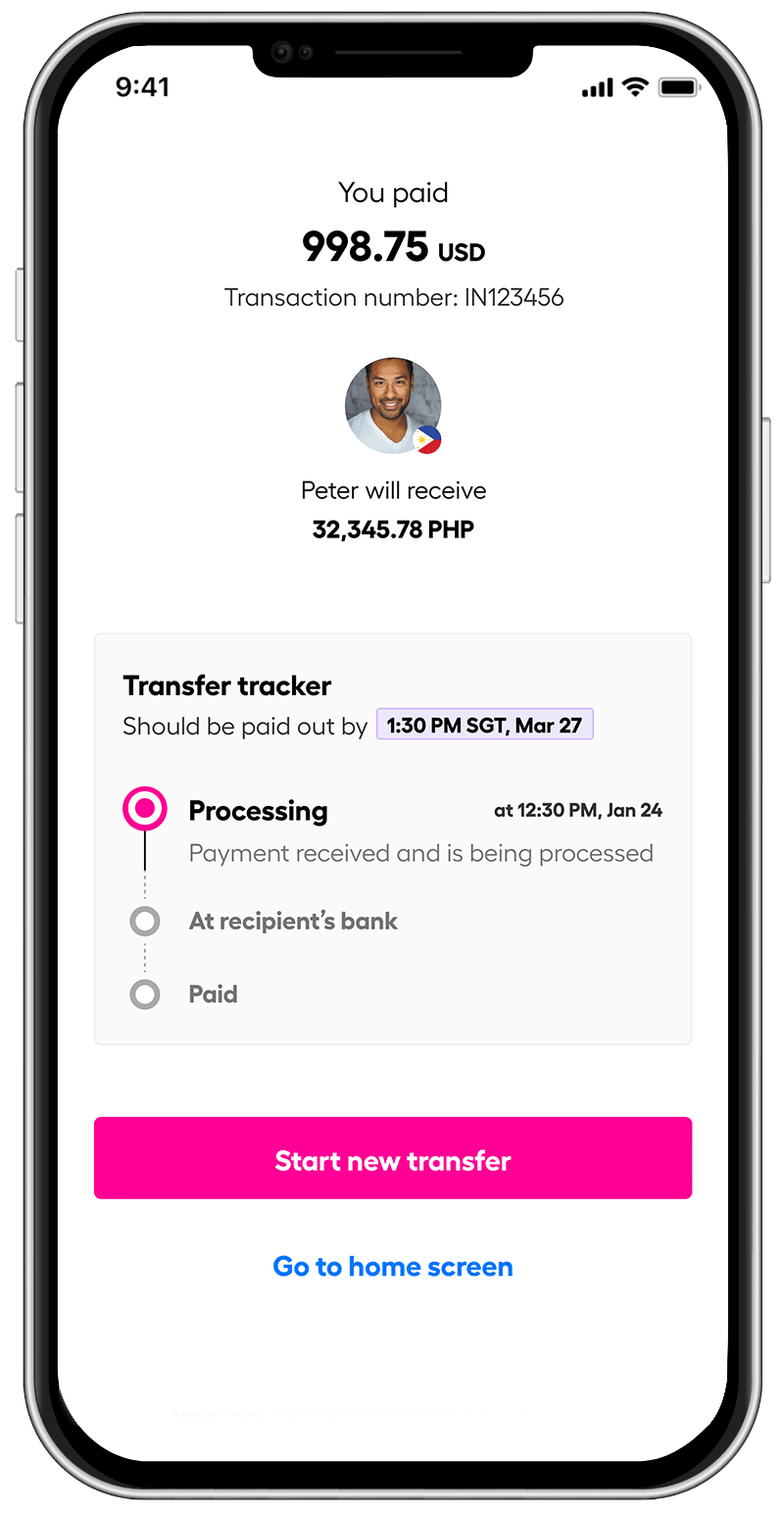

Our user-friendly platform makes transfers as simple as clicking a few buttons. And our app isn’t just pretty to look at – it allows you to track your transactions too, wrapping you in a warm blanket of peace of mind.

Try Instarem for your next money transfer.

Download the app or sign up here.

Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

Get the app

Get the app