Cost of living in Brisbane – single, family & student

This article covers:

- Overview of cost of living in Brisbane

- Do you know?

- A glance at the average cost of living in Brisbane

- Average cost of living in Brisbane: Single vs Student vs Family

- Cost of living in Brisbane as compared to other cities

- Australia Brisbane cost of living – Tax scenario in Brisbane

- What salary do you need to live in Brisbane?

- What should be your monthly budget to live in Brisbane?

- Do’s and dont’s to manage the cost of living in Brisbane

- Don’t want to live in Brisbane? Here are the top cost-effective Australian cities

- Before you go…

- FAQs

Are you planning to move to Australia, and the “Queen City of the North” – Brisbane is at the top of your list? Wondering how much is the cost of living in Brisbane. If yes, read on this blog. Brisbane is the largest city situated along the banks of the Brisbane River. It is the capital city of Queensland and is named among the best places to live for international students and young professionals.

The good news is that the cost of living in Brisbane is cheaper than other cosmopolitan cities like Sydney and Melbourne. Understanding the expenses in this Australian city will help you plan your finances before relocating.

Overview of cost of living in Brisbane

- The cost of living in Brisbane for a single person = ~ AUD 3,642 monthly and ~ AUD 43,704 annually.

- Brisbane living expenses for a family of 4 = ~AUD 7676 monthly and ~ 92,112 AUD annually.

- The average cost of living in Brisbane for students = ~AUD 2,500 monthly and ~ AUD 30,000 annually.

Do you know?

- Brisbane ranks among the top 25 cities for international students, as per QS rankings 2024. [1]

- 55.8% of the population in Queensland is in full-time employment, while the unemployment rate remains at 54%.[2]

- The University of Queensland ranks 6th in Australia and 43rd globally.[3]

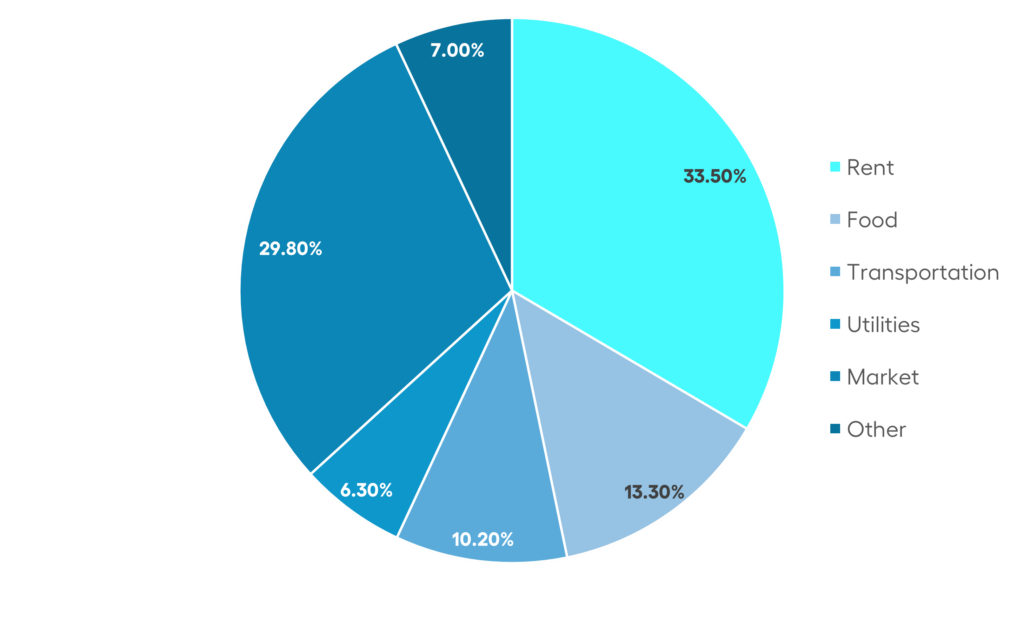

A glance at the average cost of living in Brisbane

Source: Numbeo

Average cost of living in Brisbane: Single vs Student vs Family

Type of expense | Avg. cost per month for student (AUD) | Avg. cost per month for a single (AUD) | Avg. cost per month for family (AUD) |

Housing & rent | $840 – $2,000 | $1858 | $2555 |

Food | $560 – $1,120 | $851 | $2180 |

Transportation | $90 – $120 | $388 | 998 |

Utility (electricity, water, heating, etc. ) | $170 – $215 | $175 | $257 |

Entertainment | $80 – $100 | $100 – $150 | $300 – $400 |

Source: Livingcost.org

Avg. cost of living for students: The University of Queensland

An overview of monthly rents in Brisbane

Expense Category | Item | Avg. cost per month (AUD) |

Housing | 1-bedroom apartment (in the city centre) | $2350 |

1-bedroom apartment (outside the city centre) | $1858 | |

3-bedroom apartment (in the city centre) | $3704 | |

3-bedroom apartment (outside the city centre) | $2555 |

Source:Livingcost.org

Also Read: How much does it cost to live in Australia?

Cost of living in Brisbane as compared to other cities

Type of expense | Brisbane | Sydney | Melbourne | Perth | Adelaide |

Monthly Salary (after taxes) | $5374 | $5718 | $5615 | $5395 | $4248 |

Cost of living (single) | $3642 | $4149 | $3705 | $3578 | $3331 |

Cost of living (family) | $7676 | $10167 | $8724 | $8012 | $7715 |

Rent (single) | $1858 | $1997 | $1793 | $1693 | $1475 |

Rent (family) | $2555 | $3759 | $2925 | $2708 | $2595 |

Food (single) | $846 | $863 | $818 | $862 | $877 |

Food (family) | $2166 | $2215 | $2096 | $2190 | $2208 |

Transport (single) | $386 | $626 | $532 | $380 | $282 |

Transport (family) | $991 | $1626 | $1373 | $985 | $749 |

Overall quality of life | 94 | 97 | 97 | 95 | 91 |

Source: Livingcost.org

Note: The above expenses are average costs in AUD

Australia Brisbane cost of living – Tax scenario in Brisbane

Amongst other financial considerations, it is also important to understand the tax scenario of Brisbane. Income text in Brisbane is imposed on different salary slabs or income levels, just like the rest of Australia. Every temporary or permanent Australian resident who has an income must pay the taxes according to the tax rate applicable.

The following table shows the tax obligations for different income levels in Brisbane:

Income levels in Brisbane | Tax applicable |

0 – $18,200 | Nil |

18,201 AUD – 45,000 AUD | 19c for every 1 AUD over 18,200 AUD |

45,001 AUD – 120,000 AUD | 5,092 AUD + 32.5c for every 1 AUD over 45,000 AUD |

120,001 AUD – 180,000 AUD | 29,467 AUD + 37c for every 1 AUD over 120,000 AUD |

180,001 AUD and above | 51,667 AUD + 45c for every 1 AUD over 180,000 AUD |

Source: Australian Taxation Office

What salary do you need to live in Brisbane?

According to Payscale, the average salary in Brisbane is around AUD 74,000 per year. It is an amount that helps you sustain your lifestyle in Brisbane. However, your specific salary requirements in Brisbane depend on your living circumstances and your spending.

For example, suppose you live at a reasonable location and don’t overspend on entertainment, shopping, and other variable expenses. In that case, you can easily manage to live with a monthly budget of AUD 3,000 to AUD 4,000.

On the other hand, your cost of living may dramatically increase if you prefer a luxurious lifestyle. To live comfortably while also maximizing your savings, you need to earn around AUD 90,000 to AUD 100,000 per year, which is slightly above average.

Also Read: Average Salary in Australia 2024

What should be your monthly budget to live in Brisbane?

Category | Student (AUD) | Single (AUD) | Family (AUD) |

Housing/Rent | $1,500 | $1,500 – $2,000 | $2,500 – $3,000 |

Utilities | $150 – $200 | $150 – $200 | $300 – $400 |

Food/Groceries | $500 – $1000 | $500 – $1000 | $1,000 – $2,000 |

Transportation | $150 – $200 | $150 -$200 | $200 – $400 |

Other (entertainment, shopping, personal care) | $100 – $150 | $100 – $200 | $500 – $1,000 |

Total##(approximately) | $2,300 – $3,500 | $2,400 – $4,000 | $4,500 – $8,000 |

##It is an approximate value based on the consumer prices and average living expenses of an individual. It is advisable to consider income level, spending habits, location, and specific monthly expenses to calculate an accurate budget.

Do’s and dont’s to manage the cost of living in Brisbane

Do’s

- Make a monthly budget: If you want to manage your expenses smartly, then consider creating a budget. Account for all the fixed and variable expenses, such as rent, groceries, transportation, food, healthcare, etc., and allocate a fixed portion of your earnings towards each of them. This will help you in maximizing your savings by preventing unnecessary expenditures.

- Compare rent prices: A significant part of your monthly earnings goes into paying rent or housing costs. Therefore, it is very important to choose your accommodation carefully after comparing rent in multiple neighborhoods. Generally, the cost of houses or apartments within the city centre is very high in Brisbane. So, if you want cheaper accommodation, consider exploring neighborhoods outside the city centre. Furthermore, if you are a student or someone with a very limited income, shared accommodation will be a cost-effective option for you.

- Shop at local markets: Shopping at local markets is a great way to prevent overspending online. An intelligent approach is to create a list of all the necessary items you need and shop them after comparing their costs at different stores or markets. Also, in Brisbane, you can easily find used appliances, furniture, and vehicles both online and offline.

- Explore free entertainment opportunities: Rather than spending hundreds of dollars on paid entertainment options like clubs, movies, or concerts, explore free activities like community festivals, hiking, camping, fishing, etc. This is another way to save money in Australia.

- Utilise student discounts: Student discounts are available on most categories, such as transportation, restaurants, clubs, gyms, local events, stationery and books, and even clothing and apparel. By utilising such discounts, you can save a lot of money.

Dont’s

- Overspend on restaurants: Just like any other expensive city in Australia, the cost of dining out is very high in Brisbane. A small meal at a restaurant or café can cost four times a home-cooked meal. It means that cooking your food can help you dramatically maximise your savings. To buy groceries, you can explore local farmers’ markets where you can buy fresh fruits, vegetables, and other grocery items at cheaper prices.

- Ignore health insurance: Health insurance is an important tool to deal with the rising healthcare and medical costs all over Australia, not just Brisbane. Without a suitable policy, you might end up spending thousands even for basic routine checkups.

- Overuse of credit cards: Overuse of credit cards can be a very dangerous habit when living abroad. Hence, avoid using credit cards or the popular “buy now, pay later” option if you want to avoid hefty interest rates.

- Neglect currency exchange rates: Understanding currency exchange rates becomes crucial when moving to a new country. It allows you to keep track of your expenses and also prevent overspending. Further, if you need to send money to India from Australia, then make sure to utilise a cost-effective fund transfer platform such as Instarem. It makes your overseas transactions simple and affordable#.

Also read: An expat’s guide to rent in Australia.

Don’t want to live in Brisbane? Here are the top cost-effective Australian cities

Canberra

Canberra is the capital city of the country and holds great political significance. It is known for its government institutions, local attractions, and, most importantly, an affordable cost of living compared to many popular Australian cities. If you are looking for a city with ample opportunities and a balanced lifestyle, then Canberra is the perfect place for you. Since it is a capital city, it is booming with employment opportunities in public as well as private sectors. Other sectors like IT, healthcare, and finance are also thriving in Canberra.

Average cost of living per person (without rent): AUD 1411 per month.

Cairns

If you are looking for a unique living experience in Australia with plenty of natural beauty and outdoor activities, then Cairns is a perfect option for you. It is located in the tropical region of Queensland and offers an affordable cost of living. Since it is a major tourist attraction, there are ample job opportunities in its tourism and hospitality sector. Besides, the healthcare and education sector is also growing in this city.

Average cost of living per person (without rent): AUD 1107 per month.

Adelaide

The list of the most affordable places in Australia will be incomplete without a mention of Adelaide. Apart from its affordable cost of living, this vibrant Australian city is popular for its art, culture, and traditional way of living. Additionally, Adelaide offers a wide range of work opportunities in the manufacturing, healthcare, engineering, and aerospace sectors.

Average cost of living per person (without rent): AUD 1381 per month.

Perth

Perth is quite famous among international students. While the cost of living is lower than in some top Australian towns, it is still a bit expensive. However, the availability of prestigious educational institutions and a booming job market make it an attractive place to live in. Almost all the economic sectors in Perth are brimming with opportunities, from IT and finance to mining, energy and natural resources.

Average cost of living per person (without rent): AUD 1473 per month.

Hobart

Hobart is the capital town of Tasmania, a place that acts like a tourist magnet. The town is a unique amalgamation of natural beauty and historic charm. It is an affordable Australian city popular for its holiday vibe, culinary delights, and lively atmosphere. The small size of the city makes it a very attractive option for those looking for a comfortable living experience without breaking the bank. About the job scenario in Hobart, there are many opportunities in its fast-growing tourism sector.

Average cost of living per person (without rent): AUD 1252 per month.

Before you go…

Understanding the living expenses in Brisbane is the first step towards relocating to this amazing city. It helps you navigate through finances and sustain your life comfortably in this economic hub of Queensland. Besides following the mentioned tips for managing your living expenses, make sure to utilise a trusted international fund transfer platform like Instarem. It will help you send money from Australia seamlessly and securely.

By transferring funds via Instarem, you can save a lot of money as it offers relatively lower AUD to INR exchange rates without any hidden charges. Besides, there are additional rewards given on each overseas transaction.

Try Instarem for your next transfer.

Download the app or sign up here.

Also Read: A comprehensive guide to Australia’s visa options

FAQs

- Is it expensive to live in Brisbane?

Brisbane is generally counted as an affordable city in Australia. Its cost of living is much cheaper than the top Australian cities like Melbourne and Sydney. Despite the affordability, the city offers plenty of educational institutions and employment opportunities along with a great standard of living.

- How much does it cost to live in Brisbane for International students?

An international student can live comfortably in Brisbane with a monthly budget of approximately AUD 2,000 to AUD 2,500. The cost of living for students is generally cheaper due to affordable accommodation options and the availability of student discounts. Moreover, there are ample part-time job opportunities available in Brisbane. It makes managing living expenses simple for international students.

- Is it cheaper to live in Brisbane or Melbourne?

The cost of living in Brisbane is cheaper than in Melbourne, mainly in terms of housing and food.

- What is the average room rent in Brisbane?

The cost of a single-bedroom unit is significantly cheaper than individual houses and apartments. It can range from 400 AUD to 600 AUD per week.

- How much is the cost of living in Brisbane for a couple?

The average cost of living in Brisbane for a couple ranges from 4,000 AUD to 5,000 AUD per month.

- What is the cost of living in Brisbane for a single person?

The cost of living for an individual in Brisbane is approximately 3,500 AUD to 4,000 AUD, including rent. The major part of this amount is dedicated to housing or rent. If you are on a budget, then you can bring your living expenses down by opting for shared accommodation.

- What is the cost of living in Brisbane for a family?

The cost of living in Brisbane for a family ranges between 7,000 AUD to 9,000 AUD per month, including rent. However, it can vary based on your location and type of accommodation. For affordable housing, you can explore affordable accommodations in the suburbs.

Disclaimer:

- This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

- Prices mentioned in this blog are subject to change.

- ** Fast meaning 75% of our transactions are completed in 15 minutes. Depending on the funding method.

- # When it comes to affordable exchange rates and fees, it’s worth noting that the cost will vary depending on how you choose to fund your transactions. Credit card funding and bank transfer fees can differ significantly.

Citations:

Get the app

Get the app