This article covers:

- ACH Vs Wire Transfer: Key Differences

- What is an ACH Transfer?

- Functionality of ACH transactions

- How ACH transfers work?

- Advantages and Limitations of ACH Transfers

- What is a wire transfer?

- Functionality of wire transfers

- How wire transfers work?

- Advantages and Limitations of Wire Transfer

- Factors to consider when choosing between ACH and Wire Transfer

- How secure are ACH Payments & Wire Transfers?

- Conclusion

- Frequently Asked Questions

According to a press release by the World Bank on its Migration and Development Brief, global foreign remittances have grown by 5% to USD 626 billion in 2022.

Two of the most common types of remittance in the US are wire transfer (typically for international payments) and ACH (Automatic Clearing House) within the US. Although both options have been around for some time now, there is still some confusion regarding how the payments are executed, the risks and benefits, etc.

In the article below, we shall dig deep to understand what’s the difference between ACH and a wire transfer.

ACH Vs Wire Transfer: Key Differences

Before you initiate an ACH or wire transfer, it is essential to understand their key differences. Both these modes of money transfer differ in several ways. For example, an ACH transfer is done through a clearing house, whereas a wire transfer helps transfer money from one bank to another.

Let us learn the difference between ACH and wire transfer.

Parameter | ACH Network | Wire Transfer |

Usage demography | ACH network is a US-only network where in fund transfers can happen within the US. | A wire transfer can be used domestically or internationally. |

Initiating and processing party | ACH payments are processed automatically through a clearing house | Wire transfers are initiated and processed through a bank |

Security | Due to the clearing house rules and regulations, they are more secure | Wire transfer is a secure mode of transfer, but the ACH network offers better security |

Transaction speed | Although they can be completed within the same business day, they can still be delayed due to internal reviewing processes and other factors. It typically takes 2-3 days to process a transaction. | Since they are made directly between financial institutions,Wire transfer time frame is generally shorter, within 1-2 days. |

Transaction cost | Typically, there is no or minimal ACH transfer fee involved. | This transfer method comes at a cost. A wire transfer fee may vary depending on the financial institution opted for and the transfer speed. |

Reversals | ACH transfers offer the option of transaction reversal in case of an error. ACH transfer follows a pull payment system. | Wire transfers do not offer such option as they follow push payment system |

Fund access | Funds appear in “pending” status and can be accessed only after clearance | Funds can be accessed almost immediately after the transfer takes place. |

Transfer limits | ACH transfer limits may be subject to day, month, or account. They have lower transfer limits. | Wire transfers have higher transfer limits. |

Direction | ACH transfer can be both directional (both send and receive money) | Wire transfers are single directional (only credit, that is only sending money from sender to receiver) |

What is an ACH Transfer?

ACH transfer, an acronym for Automatic Clearing House network, is a way to electronically transfer funds between banks and credit unions using an automatic clearing network system. This US-only network includes around 10,000 financial institutions, typically batched together and processed on a fixed schedule.

Both businesses and individuals can use ACH transfers (often called ACH wire transfers), and are primarily categorized under two segments:

- ACH debit transactions for direct payments

- ACH credit transactions for direct deposits

Functionality of ACH transactions

The ACH banking network can be used for various business-to-business or business-to-consumer transactions. Transactions such as direct deposits, direct debits, direct payments, electronic funds transfers (EFTs), and electronic checks (eChecks), can be completed through this network.

Some of the transfers that can be performed may include:

- Non-recurring payment of bills

- Tax refunds

- Cross-border payments

- Direct deposit of tax reimbursement or government benefits

- Direct deposit of paychecks

- Payment for healthcare claims

- Periodic payments (e.g., automated payment of bills)

- Business-to-business (B2B) payments

- Peer-to-peer (P2P) payments

How ACH transfers work?

ACH payment systems have evolved from issuing paper checks to a more trustworthy digital process. This advancement has led to faster processing, reduced or no errors, and streamlined process, enabling even peer-to-peer payment platforms to use this facility.

Here is the basic concept of how ACH transfers work:

- An ACH transaction takes place when money is transferred from one bank account or financial institution to another with the help of a payment processor or a clearing house.

- When the transaction passes through a clearing house, the network divides them into batches and processes them during the day. One must note that the bank does not process the payment; the clearing house does.

- Once the processing is done, the bank receives the payment in batches.

- These payments are then attributed (credited or debited) to their appropriate bank accounts.

Advantages and Limitations of ACH Transfers

A report by NACHA, or National Automated Clearing House Association, a body that manages and governs the ACH network, mentions that the ACH network moved 30 billion payments valued at USD 77 trillion in 2022. This rapid growth in the usage of this transfer mechanism provides several advantages for the users. Some of the advantages and limitations of ACH transfer are mentioned below:

Advantages

- Convenience: ACH payments offer a lot of convenience to businesses and individuals. It is more user-friendly. For example, for ACH debit for automating recurring payments, the customer need not fill out paperwork or remember the bills’ due dates.

- Accuracy: Since the entire process is digitalized, it eradicates the risk of human error, thus offering a more accurate transaction.

- Cost-effective: There may or may not be an ACH transfer free. Even if a fee is involved, it is typically very low, making them one of the preferred money transfer modes. Businesses that need to process high volumes of payments opt for ACH banking transfers.

- Security: Since the process involves a clearing house, these transfers must pass through strict regulations, making them more secure.

Limitations

- Availability: ACH transfers are typically limited to US use only. Although one can send an international ACH payment, not all banks yet offer this international ACH facility. However, the availability of cross-border ACH payments is improving continuously.

- Processing time: ACH payments are processed by clearing houses in batches taken up typically during the day. Thus, these transactions may take up to three business days to occur. Some transactions are eligible for same-day processing, and the number of such transactions is increasing.

- Amount limit: Banks may impose transaction limits on ACH, including a limit on the money transferred in a day, a week, a month, per transaction, per account, etc. It may even vary depending on the type of ACH transaction.

ACH Transfer Example

As mentioned earlier, ACH transfers are typically classified into direct deposit and direct payment. Let us take an example of both.

ACH Direct Deposit Example:

If you work in the US and your monthly paycheck is deposited in your bank account automatically every month, chances are the processing is taking place through the ACH network.

ACH Direct Payment Example:

If you pay your monthly utility bill electronically from your banking account, you are probably initiating an ACH direct payment.

What is a wire transfer?

Wire transfer is a money transfer method where funds are electronically transferred from one party to another. This transfer may be completed directly between bank accounts or people using a non-bank third-party wire transfer service. Wire transfers are a fast and secure way to transfer money internationally or within the same country and are administered by banks and other transfer agencies.

There are mainly two types of wire transfers:

- Domestic wire transfer

- International wire transfer (also referred to as remittance transfer)

Under federal law, international or remittance transfers must be for more than 15 USD, sent from the United States to any other country to qualify as remittance.

Functionality of wire transfers

Wire transfers are popular and ideal in scenarios where large amounts of transactions are involved. Let us look at some scenarios where there are typically used:

- People prefer transferring money via wire in real estate transactions, where individuals must pay a sizable down payment amount.

- International transactions, for example, sending money overseas, are typically completed using a wire transfer.

- Wire transactions can also be used for regular money transfers, which do not necessarily include high transaction amounts or international transfers.

How wire transfers work?

Let us know how to do a wire transfer. In wire transfers, fund transfers occur between two bank accounts, and the banks communicate directly with each other. Hence, the person sending a payment must provide the bank with details which may include:

- Transfer amount

- The recipient’s name, address, and phone number

- The recipient’s account number

- Wire transfer routing number or SWIFT code of the receiving bank or financial institution in case of international wire transfers

- The recipient bank’s address

- Once the bank has the above information, a wire transfer is initiated by deducting the transfer amount from the sender’s bank account. The sender typically pays a fee to complete this transaction. This amount is then credited to the recipient’s account.

Advantages and Limitations of Wire Transfer

Wire transfers are popular with businesses and individuals alike for many reasons. However, there are a few downsides that you must consider before opting for this money transfer method.

Advantages:

- Speed: Speed is one of the most significant advantages of wire transfer. The recipient can access the fund within hours of transfer, making it one of the most preferred fund transfer methods.

- Easy currency exchange: Most wire transfer services offer currency exchange services at affordable cost, thus making sending money in a non-local currency relatively easy.

- Zero bounce rate: Wire transfers are more reliable than checks, as checks can bounce due to insufficient funds. At the same time, wire transfers can only be initiated if the sender has sufficient funds in their account.

Limitations:

- High charges: With convenience and other advantages, wire transfer typically charges higher than ACH and other payment modes. The fee may vary depending on the chosen provider or the method used; however, it is pricey for international money transfers.

- Amount limit: Some banks or service providers may limit the maximum transfer amount per day or transaction.

- Irrevocable: The transaction cannot be revoked once the wire transfer is sent. Hence, entering the correct recipient’s details is crucial before sending a wire transfer.

Wire Transfer Example

A home buyer has sealed a deal to purchase a property for USD 50,000. To close the deal, the attorney requests the buyer to make payment via wire transfer.

The buyer visits his bank and provides the recipient’s (seller of the property) complete details, including the name, address, and contact details, the bank account number where he wishes to receive the fund, the routing number or the SWIFT code, and other details as required. The homebuyer’s account is then deducted for the amount (USD 50,000).

For initiating and processing this instruction, the sender’s bank charges a fee, which is also deducted from the sender’s bank account. Upon successful completion of the wire transfer, the amount is credited to the recipient’s account, which is accessible almost instantly.

Factors to consider when choosing between ACH and Wire Transfer

Although ACH and wire transfers aid in money transfers, there are some differences between ACH and wire transfers, as discussed in the earlier section. It is, however, crucial to decide which is better for you – ACH or wire transfer. Let us consider a few factors before making the decision.

- Amount: Typically, ACH is used for small amounts, and wire transfers are used for high-value transactions. Moreover, people prefer ACH transfers over wire transfers if the transaction is not time-sensitive.

- Frequency: Wire transactions are mostly one-time transactions, whereas ACH can be recurring.

- Destination: ACH transfers are currently limited to the United States and a few other places that have bilateral agreements with the United States. Wire transfers are accepted around the world.

- Payment transfer speed: It is better to opt for a wire transfer than an ACH transfer for quick transactions.

- Safety: Since ACHs are passed through clearing houses and undergo multiple regulations, there are more chances of finding an error or safeguarding for probable fraud, if any.

- Transfer limits: Although transaction limits may apply to ACH and wire transfers, the latter offers a higher transfer limit.

How secure are ACH Payments & Wire Transfers?

Both ACH and wire transfers offer better security than sending a paper check.

While both types of transfer require specific processes and verification, ACH transfer adds an additional layer of protection and is safer for the senders.

With clearing houses in between, ACH transactions can detect probable frauds or errors, and the transaction can be reversed under certain circumstances. Wire transfer works quicker, and the chances of reversing the transaction are a considerable challenge as the funds are accessible to the receiver almost instantly.

There are a few scams that are linked to wire transfers. However, banks and the Consumer Financial Protection Bureau (CFPB) offer fraud and consumer protection if the consumer alerts in time and no negligence is involved.

Conclusion

If you are confused about choosing between ACH or wire transfer, consider the factors mentioned in the article and weigh them according to your requirements. If you wish to transfer money overseas without the hassle and quick turnaround time, you can choose wire transfer. Likewise, if you want to pay bills regularly and are looking for a free-of-cost or minimum-cost method, ACH can be the best choice.

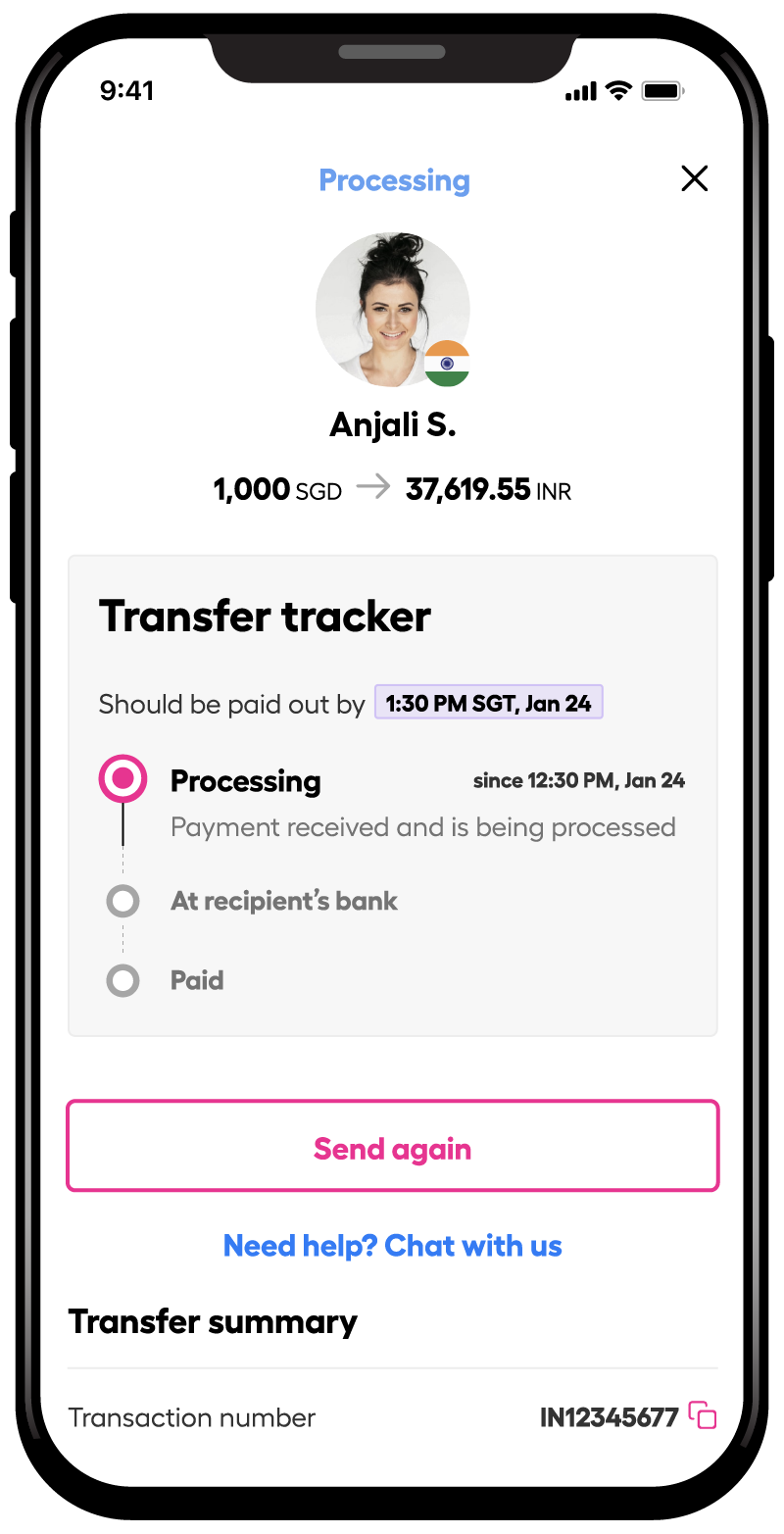

Consider switching to Instarem to experience seamless, fast** and accessible cross-border payments at a competitive price***.

Download the app or sign up here.

Frequently Asked Questions

- Is ACH a wire transfer?

ACH and wire transfers are used to transfer money but have different rules and timelines. While wire transfers processes are quick, ACH processes through a clearing house and may take a longer time.

ACH is often called ACH wire transfer in layman’s tongue because it has similar objectives as a wire transfer, but the operations of these two types of transfers are different. - Which is faster, ACH or wire transfer?

Wire transfers are generally faster as the transaction is processed immediately, and the funds are accessible almost instantly. On the contrary, ACH transfer time is typically longer than the wire transfer. - Is there a fee for ACH?

In most cases, there are no ACH transfer fees. However, even if there are any, it is a tiny amount. - How are ACH transfers most commonly used?

An ACH payment system is considered best for frequent or recurring transfers. For example, businesses may use this method to deposit employees’ salaries directly. Similarly, individuals can use this to pay monthly car insurance premiums or regular loan repayment. - Is there a limit on ACH transfers vs wire transfers?

ACH and wire transfers have limits, but wire transfer limits are higher than ACH transfers. - Who manages the ACH and wire transfer network in the United States?

NACHA governs the ACH, and the wire transfer is governed by the Consumer Financial Protection Bureau (CFPB).

Disclaimers:

This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with the products or vendors mentioned.

* *Fast meaning 75% of our transactions are completed in 15 minutes. Depending on the funding method.

***When it comes to affordable exchange rates and fees, it’s worth noting that the cost will vary depending on how you choose to fund your transactions. Credit card funding and bank transfer fees can differ significantly.

Instarem stands at the forefront of international money transfer services, facilitating fast and secure transactions for both individuals and businesses. Our platform offers competitive exchange rates for popular currency pairs like USD to INR, SGD to INR, and AUD to INR. If you're looking to send money to India or transfer funds to any of 60+ global destinations, Instarem makes it easy for you. We are dedicated to simplifying cross-border payments, providing cutting-edge technology that support individuals and businesses alike in overcoming traditional fiscal barriers normally associated with banks. As a trusted and regulated brand under the umbrella of the Fintech Unicorn Nium Pte. Ltd., and its international subsidiaries, Instarem is your go-to for reliable global financial exchanges. Learn more about Instarem.