Cost of living in Perth – single, family & student

This article covers:

- Overview: Cost of living in Perth

- Do you know?

- A glance at the average cost of living in Perth

- Average cost of living in Perth: Single vs Student vs Family

- Cost of living in Perth as compared to other cities

- Australia Perth cost of living – Tax scenario in Perth

- What salary do you need to live in Perth?

- What should be your monthly budget to live in Perth?

- Do’s and don’ts to manage the cost of living in Perth

- Don’t want to live in Perth? Here are the top cost-effective Australian cities

- Before you go…

- FAQ’s

Perth is the popular capital city of Western Australia. Surrounded by nature, it is named among the best cities for students and working professionals. It has an excellent education system and a thriving job market that offers endless career opportunities.

If you are looking forward to relocating to Perth and wondering how much is the cost of living in Perth, this blog is just for you!

Overview: Cost of living in Perth

- The cost of living in Perth for a single person = ~ 3620 AUD monthly and ~ 43,440 AUD annually.

- Perth living expenses for a family of 4 = ~ 8106 AUD monthly and ~ 97,272 AUD annually.

- The average cost of living in Perth for students = ~2,000 AUD monthly and ~24,000 AUD annually.

Do you know?

- The University of Western Australia is ranked at 83rd position in Australia and among the top 150 universities in the world.[1]

- Perth is 20% cheaper than Sydney.[2]

- Perth took a leap of 21 places to secure 12th position on the Economist Intelligence Unit’s annual Global Liveability Index Report 2023.[3]

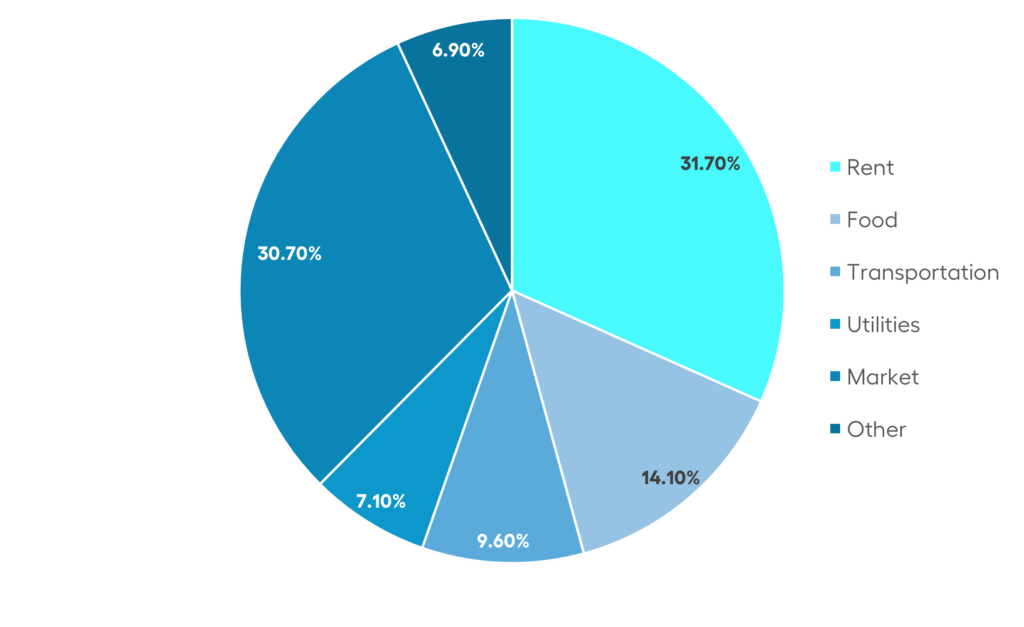

A glance at the average cost of living in Perth

Source: Numbeo

Average cost of living in Perth: Single vs Student vs Family

Type of expense | Avg. cost per month for student (AUD) | Avg. cost per month for single (AUD) | Avg. cost per month for family (AUD) |

Housing & rent | $300 – $800 | $1713 | $2740 |

Food | $696 | $872 | $2216 |

Transportation | $168 | $385 | $997 |

Utility (electricity, water, heating, etc. ) | $147 | $204 | $327 |

Entertainment | $50 -$100 | $100 – $200 | $300 – $500 |

Source: Livingcost.org

Avg. cost of living for students: Unicreds

An overview of monthly rents in Perth

Expense Category | Item | Avg. cost per month (AUD) |

Housing | 1-bedroom apartment (in the city centre) | $2329 |

1-bedroom apartment (outside the city centre) | $1713 | |

3-bedroom apartment (in the city centre) | $3645 | |

3-bedroom apartment (outside the city centre) | $2740 |

Source:Livingcost.org

Also Read: How much does it cost to live in Australia?

Cost of living in Perth as compared to other cities

Type of expense | Perth | Sydney | Brisbane | Melbourne | Adelaide |

Monthly Salary (after taxes) | $5395 | $5718 | $5374 | $5615 | $4248 |

Cost of living (single) | $3578 | $4149 | $3642 | $3705 | $3331 |

Cost of living (family) | $8012 | $10167 | $7676 | $8724 | $7715 |

Rent (single) | $1693 | $1997 | $1847 | $1793 | $1475 |

Rent (family) | $2708 | $3759 | $2538 | $2925 | $2595 |

Food (single) | $862 | $863 | $846 | $818 | $877 |

Food (family) | $2190 | $2215 | $2166 | $2096 | $2208 |

Transport (single) | $380 | $626 | $386 | $532 | $282 |

Transport (family) | $985 | $1626 | $991 | $1373 | $749 |

Overall quality of life | 95 | 97 | 94 | 97 | 91 |

Source: Livingcost.org

Note: The above expenses are average costs in AUD

Also Read: A comprehensive guide to Australia’s visa options

Australia Perth cost of living – Tax scenario in Perth

Understanding the tax implications is very crucial as it directly impacts your finances. Thankfully, the tax system in Australia is simple. You need to pay the tax according to your income level.

The following table describes the tax scenario in Perth, Australia:

Income levels in Perth | Tax applicable |

0 – $18,200 | Nil |

$18,201 – $45,000 | 19c for every 1 AUD over 18,200 AUD |

$45,001 – $120,000 | 5,092 AUD + 32.5c for every 1 AUD over 45,000 AUD |

$120,001 – $180,000 | 29,467 AUD + 37c for every 1 AUD over 120,000 AUD |

$180,001 and above | 51,667 AUD + 45c for every 1 AUD over 180,000 AUD |

Source: Australian Taxation Office

What salary do you need to live in Perth?

Inflation rates are rising worldwide, and Perth is no exception. This raises a big question: what is a good salary in Perth to live comfortably?

According to SalaryExpert, the yearly average salary in Perth is 102,000 AUD, while the lowest is 25,800 AUD per year. We have already mentioned that a single person needs approximately 3,500 AUD -4,000 AUD per month or 42,000 AUD – 48,000 AUD per year to cover his regular expenses. But to live a fulfilling life and generate wealth, individuals should aim for a salary between 100,000 AUD to 200,000 AUD per year.

Also Read: Average Salary in Australia 2024

What should be your monthly budget to live in Perth?

Category | Student (AUD) | Single (AUD) | Family (AUD) |

Housing/Rent | $800 – $1,500 | $1,600 – $2,500 | $2,800 – $3,500 |

Utilities | $100 – $200 | $100 – $200 | $200 – $400 |

Food/Groceries | $150 – $300 | $800 – $1000 | $1,500 – $2,000 |

Transportation | $100 – $200 | $300 – $400 | $800 – $1000 |

Other (entertainment, shopping, personal care) | $100 – $200 | $200 – $400 | $500 – $1,000 |

Total##(approximately) | $1,250 – $2,500 | $3,000 – $4,500 | $6,000 – $8,000 |

##It is an approximate value based on the consumer prices and average living expenses of an individual. It is advisable to consider income level, spending habits, location, and specific monthly expenses to calculate an accurate budget.

Do’s and don’ts to manage the cost of living in Perth

Do’s

Set a budget: Creating a well-defined budget should be your first step towards managing your living expenses in Perth.

Start by categorising your monthly expenses in rent/housing, food, transportation, entertainment, etc. and then allocating a specific amount of your monthly earnings to each category.

Make sure to keep your budget flexible and also include a separate category of emergency funds. Always keep in mind that simply creating a budget is not enough; implementation is the key.

Moreover, carry out a budget review at the end of each month to monitor your expenses.

Open a tax-free savings account: Once you gain the status of a resident for tax purposes in Perth, you can open a tax-free savings account or individual savings account.

This type of savings account will help you maximise your savings while reducing your tax liability.

Plan your meals: Believe it or not, planning and prepping your meals will help you save a significant portion of your earnings that would otherwise be spent on eating out at restaurants.

Besides helping you save money, eating fresh and home-cooked food will also help you stay fit and healthy.

Cut-down on unnecessary expenses: It is another important tip to save money. Start by categorising your expenses into your “needs” and “wants”.

While the former category contains unavoidable expenses (such as rent, food, utilities, etc.), the latter contains expenses such as entertainment, subscriptions, shopping, etc. that can be easily restricted.

Save on utilities: Utility bills take a significant portion of your budget. These include electricity, heating/cooling, internet, mobile packs, and so on.

You can save money by limiting the consumption of certain facilities. For example, avoid using electronic appliances extensively, use wi-fi calling instead of purchasing an international data plan, etc.

Don’ts

Indulge in impulse shopping: Impulse shopping refers to unplanned purchases that are often a result of boredom, sudden desire, and even emotional stress.

In simple words, you end up purchasing items that are completely unnecessary, leading to a waste of money.

Take loans: If you want to manage your cost of living overseas, then avoid taking any kind of formal or informal loans. They can impose significant financial debts.

Own a car: If you have limited earrings, then avoid owning a car. Car maintenance costs in Australia are very high. From motor insurance and monthly maintenance to higher fuel prices, having a personal vehicle comes with multiple expenses. Hence, consider using public transport.

Ignore AUD to INR exchange rates: Whenever you want to send money to Australia from India or any other country, keep an eye on the exchange rates, as they can impose additional financial burdens on you. A good idea is to use a cost-effective but secure fund transfer app like Instarem.

Don’t want to live in Perth? Here are the top cost-effective Australian cities

Brisbane

Brisbane is one of the finest places in Australia for expats. Best known for its tall and beautiful skyscrapers, Brisbane is the capital of Queensland. It has everything you need to live a vibrant life, from a beautiful landscape, affordable housing, a robust education system, and exceptional natural beauty. Moreover, the city offers ample work opportunities for youths from thriving sectors like IT, sales and marketing, healthcare, finance, and more.

Average cost of living (without rent): 1452 AUD per month.

Adelaide

If you want to maximise your savings in Australia, then consider moving to Adelaide. It is one of the cheapest Australian cities to live in. Not only the housing, but the overall monthly expenses are super low here.

Adelaide is the capital city of South Australia, which features a beautiful blend of old architecture and a cosmopolitan lifestyle. The student life here is also great. There are plenty of hangout places, cheap restaurants and clubs, all within the proximity.

Average cost of living (without rent): 1381 AUD per month.

Canberra

Canberra has the reputation of being the city of the government. Some of the prominent decision-makers of the country live here.

The capital city of Australia, Canberra, has one of the most powerful economies in the country, which is reflected in endless employment opportunities in both the private and government sectors.

Average cost of living (without rent): 1411 AUD per month.

Hobart

Hobart is regarded as the gateway to Tasmania, Australia’s island state. The town has a wide range of attractions, historic buildings, and numerous hiking and trekking trails.

It is a relaxed and friendly neighbourhood for both international students and workers. So, if you don’t want to live in Perth and want to live close to nature, then Hobart is the right place for you.

Average cost of living (without rent): 1252 AUD per month.

Darwin

Darwin is the tropical paradise of Australia. It is a coastal city known for its delicious seafood, rainbow birds, vibrant festivals and a year-round holiday atmosphere. It is around 13% cheaper than Perth, which makes it a great alternative.

Average cost of living (without rent): 1200 AUD per month.

Before you go…

Understanding the cost of living in Perth is crucial to navigating through the financial situation without any struggle.

Exploring affordable housing, creating an efficient budget, and cutting off unnecessary expenses are some of the ways to maintain your monthly expenses in this lively Australian city.

Meanwhile, having a hassle-free money transfer tool like Instarem will further help you manage your cross-border transactions with ease. It is a reliable fund transfer platform that offers fast**, efficient money transfer solutions at competitive rates#.

Whether you want to send money to Australia from India or any other nation, make sure to check out the amazing services and benefits provided by Instarem.

FAQ’s

Q. Is it expensive to live in Perth?

Yes. Perth comes in the category of the most expensive city to live in Australia. However, plenty of excellent job opportunities and higher average salaries balance out the living expenses in the city.

Q. How much money do you need to live in Perth?

An individual may require around 45,000 AUD per year to live comfortably in Perth, whereas a family needs approximately 96,000 AUD annually to sustain their living expenses in Perth.

Q. How much does it cost to live in Perth for International students?

An international student needs at least 2,000 AUD per month to live comfortably in Perth. Most students take part-time jobs to manage their living expenses and to earn some extra income.

Q. Is it cheaper to live in Perth or Melbourne?

According to Finder, Perth is only 2% cheaper than Melbourne. There is a negligible difference between the cost of living in both cities.

Q. What is the average room rent in Perth?

The average rent in Perth is around 400 AUD to 450 AUD per week for houses and 350 AUD to 370 AUD per week for single rooms.

Q. How much is the cost of living in Perth for a couple?

The average cost of living for a couple in Perth is roughly around 4,000 AUD to 6,000 AUD. It can be more or less depending on the specific requirements and way of living.

Q. What is the cost of living in Perth for a single person?

The average cost of living in Perth for a single person is approximately 3,578 AUD per month, including rent and transportation.

Q. What is the cost of living in Perth for a family?

The cost of living for a small family of four (a couple and two small children) is around 8,000 AUD to 9,000 AUD per month, including rent.

Disclaimer:

- This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

- Prices mentioned in this blog are subject to change.

- ** Fast meaning 75% of our transactions are completed in 15 minutes. Depending on the funding method.

- # When it comes to affordable exchange rates and fees, it’s worth noting that the cost will vary depending on how you choose to fund your transactions. Credit card funding and bank transfer fees can differ significantly.

Citations:

- [1]https://www.usnews.com/education/best-global-universities/university-of-western-australia-503979

- [2]https://www.finder.com.au/cost-of-living-comparison

- [3]https://www.eiu.com/n/campaigns/global-liveability-index-2023/

Other related blogs:

Brisbane: Cost of living in Brisbane

Sydney: Cost of living in Sydney

Melbourne: Cost of living in Melbourne

Get the app

Get the app