10 highest paying part-time jobs for students in UK 2024

This article covers:

- Getting a Part-Time Job in the UK as an International Student

- Part-Time Job Rules for International Students in the UK

- 10 Highest Paying Part-time Jobs in the UK for International Students

- Part-time Job Salary in the UK – City Wise

- Benefits of Part-Time Jobs in UK

- Types of Part-time Jobs in the UK for International Students

- How to Find Part-Time Jobs in the UK for International Students?

- Frequently Asked Questions

- Before you go…

The United Kingdom, an island country located northwest of Europe, has always been home to some of the world’s most renowned universities and educational institutions. Due to its stellar reputation of outstanding education system, vibrant cultural scene, and welcoming policies, students across the globe flock to the United Kingdom to pursue higher education.

While the UK has been infamous for its increasing inflation, leading to higher costs of living and studying, especially for international students, one cannot ignore the country’s unmatched education quality and overall learning experience. Hence, due to high education costs, part-time jobs for students in the UK are a common sight to cover their daily expenses.

Some important statistics:

- According to the Higher Education Statistics Agency (HESA), in the academic year 2021-22, 679,790 international students were studying at UK higher education institutions.

- According to the Guardian analysis, one in every five pounds received by UK universities in 2021-22 came from international students.

- The Government caps undergraduate fees for publicly funded institutions for ‘home’ status students at £9,250. The ‘Overseas fees‘ are generally higher and are charged to the international students, depending on the course and provider.

Getting a Part-Time Job in the UK as an International Student

International students who wish to do a part-time job in the UK must have a Tier 4 visa, which allows them to study and work. However, there are a few eligibility criteria that must be fulfilled and regulations that must be met.

Firstly, you must ensure your university or institute imposes no restrictions on taking up a part-time job in the UK.

Eligibility requirements for part-time jobs in the UK for international students:

- Students must be 16 years or above

- They must be enrolled in full-time degree programs at the universities

- They must hold a Tier 4 visa.

Part-Time Job Rules for International Students in the UK

While the UK Tier 4 visa allows international students to work, the following are the part-time job rules applicable in the UK:

- Full-time degree students can work up to 20 hours per week during terms and full-time during breaks. During session breaks, students can work 40 hours per week.

- Students enrolled in foundation-level courses can work 10 hours per week during the course term.

- Restrictions on working hours may be imposed depending on the course you are enrolled in and the Tier 4 sponsor.

Part-Time Jobs not allowed:

- Cannot work as full-time employees;

- You cannot work as a doctor or dentist in training unless you are pursuing a foundation-level program in either of these fields;

- Cannot work as an entertainer or sportsperson;

- Cannot freelance, opt for contractual work or run a business.

Also Read – Top 8 reasons to study in the UK

10 Highest Paying Part-time Jobs in the UK for International Students

Finding the best part-time in the UK is not easy; hence, here is a list of high-paying jobs in the UK.

Type of Job | Average Pay per Hour (GBP) |

Tutor | £15 – £30 |

Dog Walker | £12.50 |

Waiter | £12 |

Customer Service Representative | £11 |

Translator | £10 – £20 |

Library Assistant | £10 – £15 |

Prep Cook | £10 – £12 |

Barista | £10 |

Retail Assistant | £9.88 |

Receptionist | £9 |

1. Tutor

Job Details | Tutoring is one of the best part-time jobs in the UK to earn extra income while studying. This job is flexible as you can tutor online and schedule according to your course plan, making it one of the most sought-after part-time jobs in the UK. Tutoring can be rewarding, help you earn good money and enhance your academic strength. |

Expected Salary Bracket | Depending on the students (elementary, high school or fellow students), the subjects or skills you teach, the average part-time salary in the UK for this job can be around £15 – £30. |

Eligibility | No formal qualification is required, but academically strong students or expertise in a skill (like a musical instrument) are typically preferred. |

2. Dog Walker

Job Details | International students can offer dog walking services to people in the UK as part-time jobs. Dog walker is one of the most sought-after profiles in the UK. The job can be a great stress reliever, enjoyable and bliss for animal lovers. Dog walkers can opt for flexible timing as per their study schedule. |

Expected Salary Bracket | Per hour salary in the UK for a dog walker is around £12.50 |

Eligibility | No formal qualification is required. |

3. Waiter

Job Details | Servers or waiters are excellent part-time jobs in the UK preferred by many international students. The work is relatively straightforward and requires them to interact with the customers, provides options for flexible hours and offers decent pay. Students aiming for the hospitality sector can gain immense knowledge about the workings of the sector by choosing this job. |

Expected Salary Bracket | Per hour salary in the UK for students taking up server jobs is around £12 |

Eligibility | No formal qualification is required. |

4. Customer Service Representative

Job Details | Customer Service Representatives (CSR) are responsible for addressing customer queries, solving their problems, providing product support, etc., on calls or through email and chats. Flexible working hours and good pay make this job lucrative. |

Expected Salary Bracket | Per hour salary in UK for students engaged in CSR is £11 |

Eligibility | Students are trained thoroughly before going on calls. Students with good communication skills are usually preferred. |

5. Translator

Job Details | One of the best part-time jobs in the UK for students having a good command of multiple languages is translators. Translating services are required for articles, videos and other long and short forms of content. Students can work part-time, brush up their language skills and earn decent pay. |

Expected Salary Bracket | The UK part-time job salary for translators is between £10 – £20. |

Eligibility | A good command over language (s) is a must.. |

6. Library Assistant

Job Details | International students looking for on-campus jobs can apply to university libraries for this position. Alternatively, there are public libraries, too, which allow students to work part-time. The role of the library assistant is to assist patrons in finding books and other materials, organising the shelves, etc. |

Expected Salary Bracket | A library assistant can earn between £10 – £15 per hour in the UK. |

Eligibility | No formal qualification is mandatory. |

7. Prep Cook

Job Details | If you’re passionate about cooking, prep cook is your ideal job. As a prep cook, you will make meals, take instructions from the head chef or other senior chefs and assist them in cooking. This job can improve your culinary skills and provide exposure to work under pressure with tight deadlines. |

Expected Salary Bracket | A prep cook’s part-time job salary in the UK is around £10 – £12 per hour |

Eligibility | Students studying hospitality or culinary skills look out for this job. You can start without having any formal training. |

8. Barista

Job Details | The job profile of a Barista includes making and serving coffee in coffee shops, cafes, and restaurants. Moreover, they must prepare the set-up for opening, take and prepare orders, do cleaning tasks, etc. So, if you love the coffee shop vibe, this job is right for you. |

Expected Salary Bracket | A barista can earn a £10 per hour salary in the UK. |

Eligibility | Students must have a basic understanding of preparing snacks or café. No specific qualification is necessary. |

9. Retail Assistant

Job Details | Retail assistants help customers find products, stock shelves, and organise and process payments. This job offers students flexible timing, decent pay and invaluable customer service experience. |

Expected Salary Bracket | The average part-time salary in the UK for retail assistants is £9.88 per hour. |

Eligibility | Good interpersonal skills are an add-on for a retail assistant’s job. |

10. Receptionist

Job Details | Receptionists are one of the most preferred jobs in the UK for students. As a receptionist, you will welcome guests, answer phone calls, address customer queries and perform other administrative tasks. |

Expected Salary Bracket | The average part-time salary in the UK for retail assistants is £9.88 per hour. |

Eligibility | In the UK part-time job salary for receptionist students is £9. |

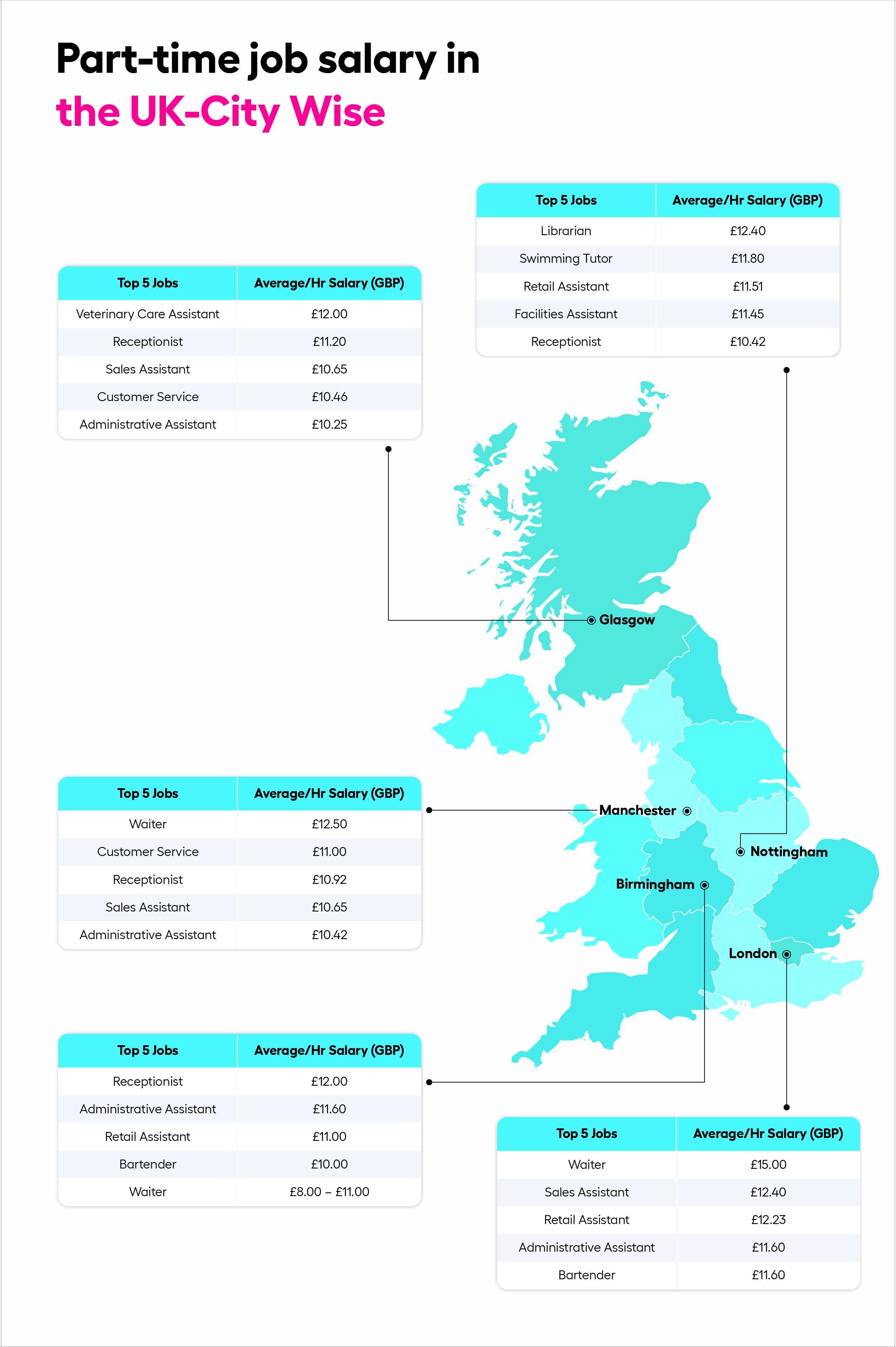

Part-time Job Salary in the UK – City Wise

The United Kingdom is one of the most popular destinations for international students. Apart from esteemed universities, innumerable course offerings and a welcoming culture, students can work while they study. Below are some popular cities with the top 5 jobs and their part-time job salary in the UK.

London

Top 5 Jobs | Average Per Hour Salary (GBP) |

Waiter | £15 |

Sales Assistant | £12.40 |

Retail Assistant | £12.23 |

Administrative Assistant | £11.60 |

Bartender | £11.60 |

Nottingham

Top 5 Jobs | Average Per Hour Salary (GBP) |

Librarian | £12.40 |

Swimming Tutor | £11.80 |

Retail Assistant | £11.51 |

Facilities Assistant | £11.45 |

Receptionist | £10.42 |

Birmingham

Top 5 Jobs | Average Per Hour Salary (GBP) |

Receptionist | £12 |

Administrative Assistant | £11.60 |

Retail Assistant | £11 |

Bartender | £10 |

Waiter | £8 – £11 |

Manchester

Top 5 Jobs | Average Per Hour Salary (GBP) |

Waiter | £12.50 |

Customer Service Representative | £11 |

Receptionist | £10.92 |

Sales Assistant | £10.65 |

Administrative Assistant | £10.42 |

Glasgow

Top 5 Jobs | Average Per Hour Salary (GBP) |

Veterinary Care Assistant | £12 |

Receptionist | £11.20 |

Sales Assistant | £10.65 |

Customer Service Representative | £10.46 |

Administrative Assistant | £10.25 |

Must Read: Average salary in the UK

Benefits of Part-Time Jobs in UK

Part-time jobs in the UK for international students can be beneficial for several reasons; a few are listed below.

- Taking up a part-time job while studying helps cover the cost of living in the UK.

- It helps you develop communication, time management, multi-tasking, and management skills.

- Working part-time on a job related to your course can help you gain valuable experience and exposure to your field.

- You will learn to build network and professional relationships, which are helpful to kick start your career.

- You will learn to use your money responsibly.

Types of Part-time Jobs in the UK for International Students

International students can have part-time jobs in the UK in two ways.

- On-campus: As the name suggests, on-campus part-time jobs are accessible to students within the university campus. It’s a top choice as students work in their departments, saving travel time.

Examples: Employment opportunities available in the libraries, laboratories, cafeterias, admin department, etc.

- Off-campus: These are job opportunities available outside the campus premises. Students typically look out for jobs that are closer to their university/institute or place of residence. Ample opportunities are available through this option.

Examples: Working in companies, offices, restaurants, cafés, etc.

How to Find Part-Time Jobs in the UK for International Students?

There are several ways to find the best part-time jobs in the UK. A few sources through which international students can find jobs are:

- Look for jobs available on campus

- Take help from your university’s/institute’s recruitment team

- Search in local newspapers

- Search for jobs through online portals

- Use your networks

- Get in touch with a recruitment agency

Also Read: Top 12 money tips for students moving to the UK

Frequently Asked Questions

Can Students work part-time in the UK?

Students holding Tier 4 Student visas and enrolled in full-time degree-level courses are permitted to work part-time in the UK.

How much do part-time jobs pay in the UK?

The part-time job salary in the UK depends on various factors, including the job role, industry, employer, location, duration, etc. The National Minimum Wage revised on April 2023 is as follows:

Under 18 years: £5.28

18 to 20 years: £7.49

21 to 22 years: £10.18

23 years and above: £10.42

Which part-time jobs pay the most in the UK?

Tutor (£15 – £30), dog walker (£12.50), waiter (£12) and Translator (£10 – £20) are some of the part-time jobs for students that offer the best salaries.

Is getting a part-time job in the UK easy?

The UK offers many opportunities for students; hence, getting a part-time job is relatively easy.

Can I work 50 hours a week UK?

Full-time degree students can work up to 20 hours per week during semesters and full-time (40 hours per week) during session breaks.

Individuals cannot work more than 48 hours a week unless they go for an ‘opt-out agreement’.

Before you go…

Finding the best part-time jobs in the UK, especially for international students, can be tiring but a rewarding experience. As an international student, you must do proper research about the requirements for the job and the salary aspect before applying.

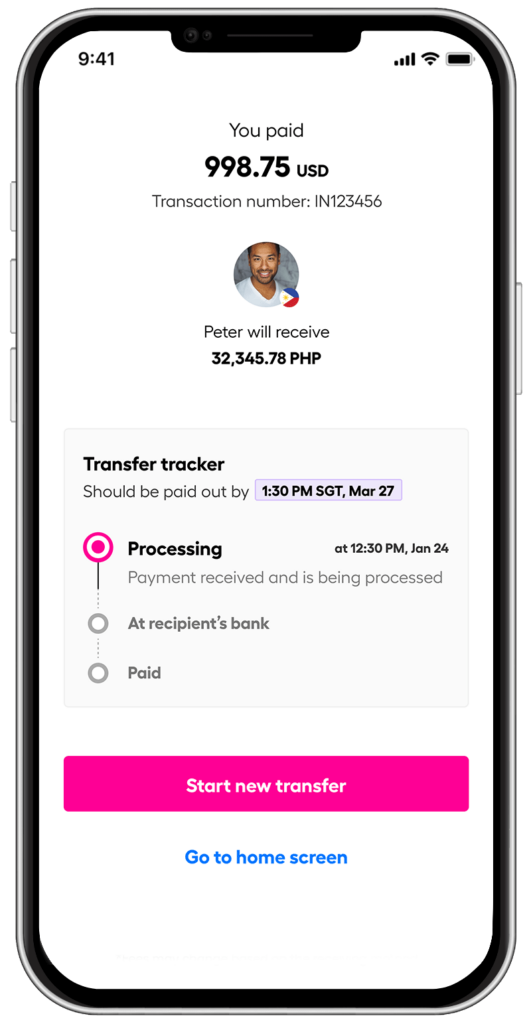

Moreover, if you wish to send money from the UK to your home country, trust Instarem. Instarem offers a fast*, reliable, and affordable# money transfer facility from the UK to various countries across the globe.

For example, if you wish to send money to India from the UK, firstly, you can use the currency converter tool to know how much funds would be received by your Indian counterpart. The tool displays pounds to INR conversion in a fraction of a second. Then, create an account, choose payment mode, add recipient details, and viola, your funds are transferred.

Try Instarem for your next transfer.

Download the app or sign up here.

Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

Other related blogs:

Australia – Part-time jobs for students in Australia

USA – Part-time jobs for students in USA

Canada – Part-time jobs for students in Canada

Singapore – Part-time jobs for students in Singapore

Germany – Part-time jobs for students in Germany

Ireland – Part-time jobs for students in Ireland

Instarem stands at the forefront of international money transfer services, facilitating fast and secure transactions for both individuals and businesses. Our platform offers competitive exchange rates for popular currency pairs like USD to INR, SGD to INR, and AUD to INR. If you're looking to send money to India or transfer funds to any of 60+ global destinations, Instarem makes it easy for you. We are dedicated to simplifying cross-border payments, providing cutting-edge technology that support individuals and businesses alike in overcoming traditional fiscal barriers normally associated with banks. As a trusted and regulated brand under the umbrella of the Fintech Unicorn Nium Pte. Ltd., and its international subsidiaries, Instarem is your go-to for reliable global financial exchanges. Learn more about Instarem.